What's the Best Utility for Your Portfolio?

Utility stocks used to offer investors a very simple investment decision: Look at who kept your lights on, and buy its stock. Not so these days, as there is a lot more to consider when investing in a utility. To help you better determine which utility stock you'll want to buy, I've compiled the top reason why you'd want each company in your portfolio.

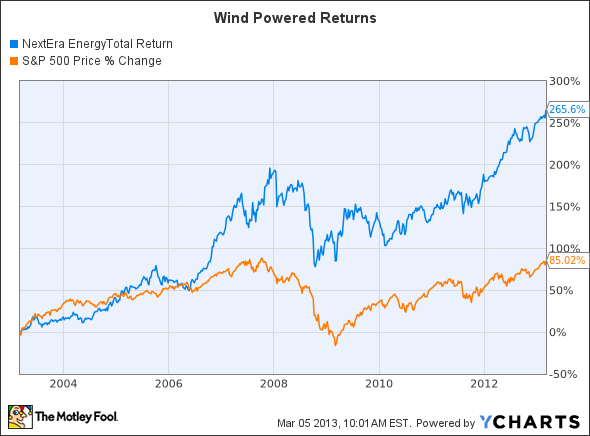

If you want a wind-powered winner

Shares of NextEra Energy have crushed the S&P 500 over the past decade, as the company has become the name to own in renewables:

NEE Total Return Price data by YCharts

The company recently announced that it added its 10,000th MW of wind generation. It's taken the company $16 billion to get there, but, as you saw in that chart, it's been money well spent. While the company's dividend yield of just over 3.5% is on the low side, NextEra has plans to grow it by 10% per year, given its visible pipeline of nearly $10 billion in growth projects that it has planned. That growth is likely to continue generating solid returns for investors.

If you want to turn on the gas

While renewables are all the rage, we still have a lot of cheap gas under our feet. One utility that's doing something about it is Dominion Resources . The company has a natural gas midstream business embedded within its Energy segment. That midstream segment is generating a lot of income through its 11,000 miles of natural gas transmission, and gathering pipelines and nearly a trillion cubic feet of natural gas storage. Meanwhile, hidden away is its Cove Point LNG facility that is being prepped for natural gas exports, meaning that it could be a real hidden gem for Dominion investors.

Dominion plans to spend $3 billion per year on growth projects, which will translate into 5% to 6% earnings growth. That's enough for the company to slowly grow its dividend payout ratio, and grow its dividend by 6% to 7% annually. That makes today's near 4% yield pretty enticing for income-seeking investors.

If you want the nuclear option

Even as Dominion and NextEra have plans to grow investor payouts, Exelon's recently went in the opposite direction. The nation's top nuclear power generator has seen its earnings drop off as power prices have come down along with the price of natural gas. That's also taken a bite out of Exelon's shares, which are now trading at a rather large discount to the aforementioned peers as you can see in this chart:

EXC Price / Book Value data by YCharts

That's where the real story lies with an investment in Exelon. The company owns some really valuable assets that will continue to generate clean and reliable energy for years to come. The problem here is that the company simply can't afford to spend on the same levels as its peers to grow its clean generation, so you won't see the organic earnings growth or consistently growing dividend for at least the next few years. Instead, an investment in Exelon is one that says its undervalued assets will produce higher earnings once power prices head higher.

My Foolish take

Personally, my money's on Exelon. With its cheap shares and dividend now more in-line with its peers, the company is a really interesting value at these levels. It's clean nuclear generation is simply worth a whole lot more than the market is giving it credit.

That's why, as the nation moves increasingly toward clean energy, Exelon is perfectly positioned to capitalize on having the largest nuclear fleet in North America. Combine this strength with an increased focus on renewable energy, and EXC's recent merger with Constellation places Exelon and its best-in-class dividend on a short list of top utilities. To determine if Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

The article What's the Best Utility for Your Portfolio? originally appeared on Fool.com.

Matt DiLallo has the following options: Short Apr 2013 $35 Puts on Exelon. The Motley Fool recommends Dominion Resources and Exelon. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.