Buffett's New Top Stock

One thing is for sure: Wells Fargo's product isn't nearly as tasty as Coca-Cola's . As far as the stocks go, however, Wells now has the edge on Coke when it comes to the Warren-Buffet-led portfolio at Berkshire Hathaway .

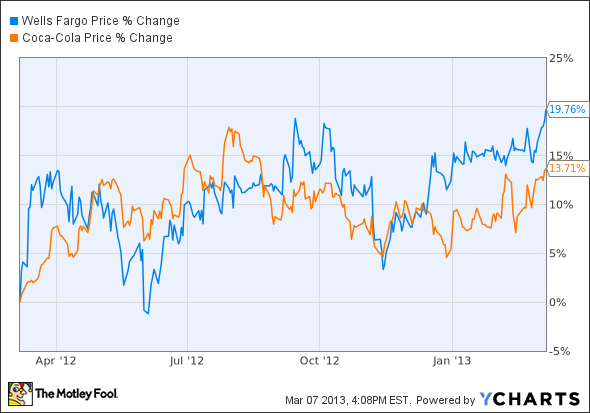

Over the past couple of weeks, Wells Fargo has wrestled that spot away from the longtime champ. How did it happen? Part of it was Wells Fargo's stock outperforming Coke's -- particularly since late last year.

But that's not all. Buffett didn't touch his Coke investment last year. On a split-adjusted basis, it was at 400 million shares at the end of 2011. At the end of 2012, it was still at 400 million. Berkshire's Wells Fargo share holdings, on the other hand, increased almost 15% during 2012. At Wells' average 2012 stock price, that's an additional commitment of $1.8 billion.

Buffett's love of Wells Fargo is one of those things that's hidden in plain sight, if you want to say it's hidden at all. But for the Buffett tea-leaf readers wondering where the Oracle sees value and opportunity today... well, I think we have at least one clear answer.

Wells Fargo's secret to success

Wells Fargo's dedication to solid, conservative banking helped it vastly outperform its peers during the financial meltdown. Today, Wells is the same great bank as ever, but with its stock trading at a premium to the rest of the industry, is there still room to buy, or is it time to cash in your gains? To help figure out whether Wells Fargo is a buy today, I invite you to download our premium research report from one of The Motley Fool's top banking analysts. Click here now for instant access to this in-depth take on Wells Fargo.

The article Buffett's New Top Stock originally appeared on Fool.com.

Matt Koppenheffer owns shares of Berkshire Hathaway. The Motley Fool recommends Berkshire Hathaway, Coca-Cola, and Wells Fargo. The Motley Fool owns shares of Berkshire Hathaway and Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.