Should You Buy These Oversized Biotechs?

It's not uncommon for biotechs to double or more overnight. Drug development is risky, which holds down the price. When it becomes clear a drug works or gets approved by the FDA, it's natural to see companies turn that risk into substantial reward.

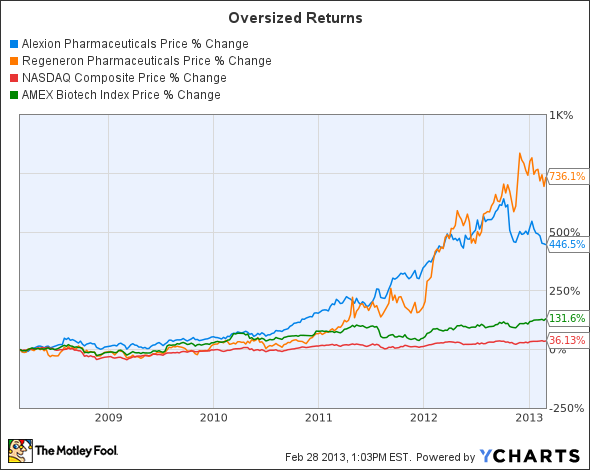

Alexion Pharmaceuticals and Regeneron Pharmaceuticals , on the other hand, have increased their shares several-fold with the old-fashioned, slow-and-steady method.

How they got here

Both Alexion and Regeneron's rise to stardom has come on the back of a single drug.

Alexion only sells one drug, Soliris. The drug is approved for two rare diseases: paroxysmal nocturnal hemoglobinuria, where patients experience excessive destruction of red blood cells; and atypical hemolytic uremic syndrome, which causes patients to get potentially life-threatening blood clots.

Soliris isn't approved to treat that many patients, but what it lacks in volume, it makes up for in price: $440,000 per patient per year. Sales of the drug topped $1.1 billion in 2012, up 45% year over year.

Regeneron has three drugs on the market, but only one of them is important at this point. Arcalyst treats a set of ultra-orphan diseases called Cryopyrin-Associated Periodic Syndromes; the drug only managed $20 million in sales in 2012. Regeneron's cancer drug Zaltrap has more potential; its partner Sanofi sold $23 million in the fourth quarter, its first full quarter on the market. But Regeneron captures very little of those sales because much of the profit goes to pay back Sanofi for the development of the drug.

That leaves Regeneron's macular degeneration drug Eylea, which has been a rock star since its launch. Despite having an entrenched leader in Roche's Lucentis and a cheaper off-label competition from Roche's Avastin, Eylea racked up $276 million in sales during the fourth quarter alone.

Expensive

With market caps of more than $16 billion each, Alexion and Regeneron are pretty large biotechs. They're about half the size of Gilead Sciences and Biogen Idec , but look at how their valuations compare.

Company | Price/Earnings | Enterprise Value/Revenue |

|---|---|---|

Alexion | 67.6 | 14.2 |

Regeneron | 24.4 | 11.7 |

Gilead | 26.2 | 7.2 |

Biogen Idec | 28.8 | 7.0 |

Source: S&P Capital IQ.

While Regeneron's earnings look comparable, it's partially because of milestone payments from its partners. Its valuation relative to revenue is also skewed because it books research and development dollars from its collaborators as revenue, but they just flow through to the expense line. Regeneron's enterprise value to product sales ratio is a whopping 18.8.

Looking at their valuation relative to the revenue they bring in shows how expensive they are. Put another way, if Alexion wants to double its valuation to be the same value as Gilead and Biogen, it'll need to quadruple its sales to be comparable.

All about the next drug

It's impossible to justify buying either company based on their current sales. The current valuation is clearly taking future revenue into account.

Alexion is trying to expand the use of Soliris into a couple of additional diseases. It also has a phase 2 orphan drug called asfotase alfa to treat a rare metabolic disease called hypophosphatasia, and three other drugs further back in the clinic.

Regeneron's pipeline is a little more packed with two additional phase 3 drugs, two phase 2 drugs, and a laundry list of phase 1 candidates. But it has to share the rights to those drugs with its longtime partner, Sanofi.

Which one?

They both look overpriced to me. Then again, I thought they had crazy valuations a year ago, and both have posted solid revenue growth that's pushed their share prices higher. If I had to pick one, I'd probably go with Regeneron just because of the added shots on goal should make it a little less risky at these lofty valuations.

Speaking of revenue potential...

It's hard to argue about the potential sales opportunity for obesity drugs. The question is just whether VIVUS and Arena Pharmaceuticals can capture those potential sales. For more insight, grab copies of The Motley Fool's premium research reports on VIVUS and Arena Pharmaceuticals to stay up to date. The reports contain the must-know information, including an in-depth look at the obesity market and reasons to buy and sell both stocks. Click now for an exclusive look at Arena and VIVUS -- complete with a full year of free updates -- today.

The article Should You Buy These Oversized Biotechs? originally appeared on Fool.com.

Fool contributor Brian Orelli has no position in any stocks mentioned. The Motley Fool recommends Gilead Sciences. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.