Apple and BlackBerry Fight It Out for 5% in India

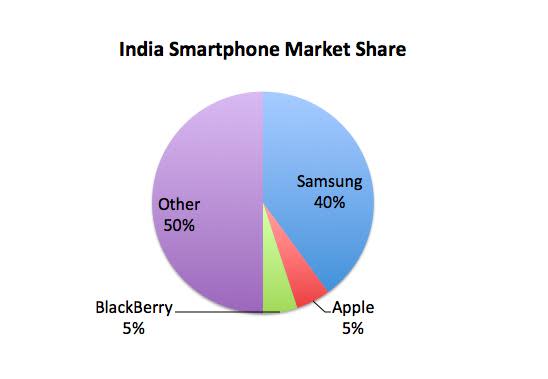

BlackBerry launched its new Z10 smartphone in India earlier this week in hopes of tapping into one of the fastest-growing smartphone markets in the world. But the company is facing stiff competition: Apple recently ramped up its iPhone marketing and distribution efforts in the country. Right now, both companies have about 5% smartphone market share in India -- a percentage both companies, and their investors, want to grow.

A bitter Apple

Apple began selling the iPhone in India about four years ago, but the iPhone isn't exactly a smartphone for the masses. It's premium pricing doesn't lend itself well to markets where prepaid, no-contract phones dominate -- like in India. A recent Reuters article pointed out that the price of a new iPhone 5 is the same as two months' salary for an entry-level software engineer in India. The iPhone's high price point is one of the reasons the company is sitting near the bottom of India's smartphone market share.

Source: Reuters.

To fix this, Appleset up installment plans for iPhones, and recently added two new distributors for the phones. With these two changes, a major retail chain in India that sells 15% of all iPhones in the country saw sales triple this past December to January. But so far, the company is still struggling to wrestle more market share away from Samsung and other competitors.

BlackBerry's (less than) triumphant return

BlackBerry is slightly ahead of Apple in Indian smartphone market share, taking the No. 5 spot in India ahead of Apple's No. 6. But up until last year, BlackBerry had about 10% of the market, so the company is fighting to gain back old ground, not expand into new territory.

With the launch of the Z10 in India this week, BlackBerry is going to face a similar pitfall that Apple faced several years ago. About 95% of cell phone users in India have no-contract, pre-paid plans and carriers in the country don't subsidize phones. The Z10, unsubsidized, comes in at a staggering $800. That's an expensive phone by any country's standard. BlackBerry is working to set up installment plans like Apple's, but it's questionable that the company could earn significant market share in the country with such an expensive phone.

The Z10 is launching in 2,000 retail locations in 50 cities, but that won't matter much if consumers in India can't afford it. The Z10's debut in India comes just as two analyst firms cut the phone's sales estimates for Canada and the U.K. BlackBerry can't afford the Z10 not to sell in markets like India, because emerging markets are where the company has the strongest growth in sales volume.

The long haul

Both companies know how important India is to the future of mobile, but as it stands right now, neither one has introduced what Indian consumers really need: a cheaper phone. Rumors of a low-cost iPhone have resurfaced recently, but Apple is mum about any possibly plans.

Investors need to see Apple and BlackBerry introduce low-cost smartphones in India, and other emerging markets. While Apple may have seen a spike in sales from installment plans, it's uncertain how long that angle will play out. With Samsung and local players eating up an overwhelming percentage of India's smartphones, it's obvious that cheaper phones are what Indian consumers want. If Apple does come out with a cheaper iPhone, and BlackBerry doesn't follow suit, it's easy to imagine Apple grabbing much more of India's smartphone market share.

With BlackBerry betting everything it has on its new OS, it needs the Z10 to sell in every market, including India. Apple is far less desperate to see sales grow quickly in the country, but an increase in iPhone sales there would be a bit of good news for the company. Apple has dominated the U.S. mobile market, but some investors are beginning to wonder whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on both reasons to buy and reasons to sell Apple, and what opportunities are left for the company (and your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

The article Apple and BlackBerry Fight It Out for 5% in India originally appeared on Fool.com.

Fool contributor Chris Neiger has no position in any stocks mentioned. The Motley Fool recommends Apple. The Motley Fool owns shares of Apple. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.