Can You Trust the McDonald's Dividend?

Income investors love stability. A rock-steady stock chart comes in handy if you ever find a reason to sell your cash-dispensing shares, but predictable dividends are where the real magic happens.

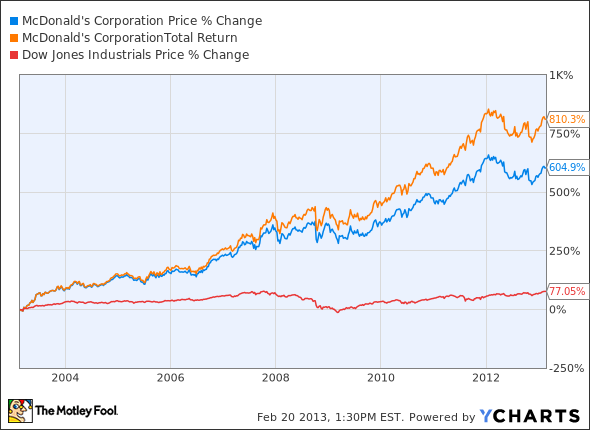

Today, I'll take a closer look at dividend hero McDonald's . The fast-food king has absolutely crushed its peers in the Dow Jones Industrial Average index over the last decade, and dividend payments have made a large difference along the way:

At today's prices and payouts, Mickey D's generous 3.3% yield tied with Microsoft for the seventh-richest yield on the Dow. But can we expect McDonald's to keep paying these huge dividends?

Over the last four quarters, McDonald's generated $3.9 billion in free cash flows, of which $2.8 billion was returned to shareholders in the form of dividend checks, making for a 72% cash payout ratio.

You may call it a generous policy, but I find it a little scary. Many high-yield stocks support their payouts with a much smaller portion of their cash flows. For example, Microsoft put just 26% of its free cash into that 3.3% yield over the last year. That's a far more sustainable payout.

To put the current policy in a different perspective, McDonald's allocated just 25% of its free cash to dividends in 2003. Going back to that ratio would result in the Dow's second-lowest yield -- a meager 1.1%. Moreover, McDonald's has spent about $3 billion annually on share buybacks in the last six years. In other words, the company is dipping into the cash register to keep its shareholders happy.

McDonald's shareholders would be wise to keep an eye on this worrisome trend. It's not clear that the company can keep both dividends and buybacks this generous for much longer -- and investors hate to see dividend cuts. This market-beating chart could turn ugly in a hurry.

After making investors rich in 2011, McDonald's was one of the worst-performing blue chip stocks of 2012. Our top analyst on the company will tell you whether you should be worried by this trend, and he'll shed light on whether McDonald's is a buy at today's prices. Click here now to read our premium research report on the company.

The article Can You Trust the McDonald's Dividend? originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of McDonald's. Motley Fool newsletter services have recommended buying shares of Microsoft and McDonald's. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.