Can This Insurer Continue to Rise Above Its 52-Week High?

Shares of Assured Guaranty continue to go up in advance of earnings next week, hitting a new 52-week high on Tuesday. Let's take a look how it got here and if it can potentially go even higher.

How it got here

The monoline insurer's dramatic rise began in earnest with a victory in court against Flagstar Bancorp earlier this month. In the case, Assured alleged that that Flagstar had stuffed defective mortgages into securities they were asked to guarantee. Judge Jed Rakoff ruled in favor of Assured and ordered that Flagstar pay Assured $90.1 million plus attorney fees and other costs .

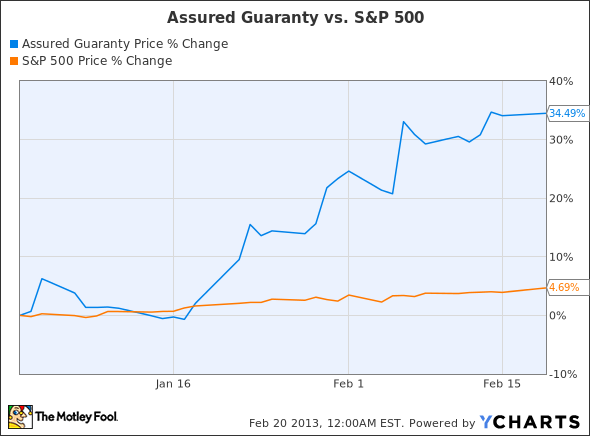

This news was well received by the markets, with Assured shares trading up as much as 11.7% on February 6th. Overall, Assured has been doing well early in 2013, with the share price up over 34% so far this year, while the market is up just under 5%:

What's ahead for the company

Assured is set to release fourth-quarter earnings next Wednesday , so investors will be able to get a better handle on how the insurer will perform going forward. Analysts are expecting $0.70 EPS for the quarter, and $2.50 EPS for the entirety of 2012, which would both mark a decline from 2011. Assured's performance will go a long way to determining if the company will remain perched at its lofty heights, and if investors will continue to reap those rewards. One thing investors can look forward to is a higher dividend, with Assured announcing an 11% increase to its quarterly dividend shortly after winning its court battle with Flagstar, pushing its yield to nearly 2%.

The Assured Guaranty/Flagstar Bancorp situation is very similar to a looming fight between Bank of America and MBIA, so it might be a good opportunity for you to find out if looming legal risks are a threat to B of A and other banks like it. To learn more about the most talked-about bank out there, check out our in-depth company report on Bank of America. The report details the bank's prospects, including three reasons to buy and three reasons to sell. Just click here to get access.

The article Can This Insurer Continue to Rise Above Its 52-Week High? originally appeared on Fool.com.

Fool contributor Robert Eberhard has no position in any stocks mentioned. The Motley Fool owns shares of Bank of America. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.