Should You Buy or Sell Rackspace Today?

Rackspace Hosting finds itself in unfamiliar territory today.

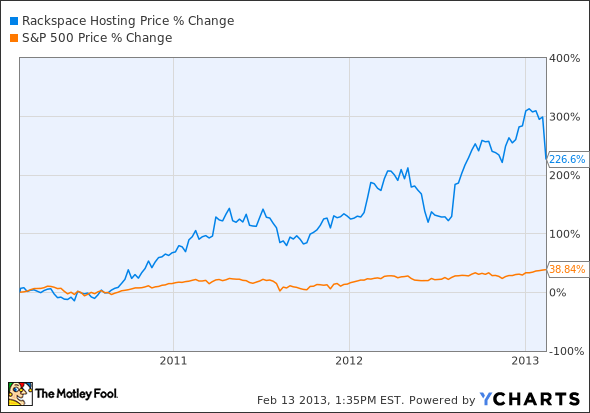

The stock plunged 18% on Wednesday, making it one of the worst performers in the entire stock market. That's a drastic change for a stock that had gained 38% in the previous six months and more than quadrupled in the past three years. The tide suddenly turned against a proven market darling.

The company reported fourth-quarter results Tuesday night. Rackspace roughly met Wall Street's revenue expectations with a $353 million top-line performance but whiffed a little bit on the bottom line, where its $0.21 of adjusted earnings per share fell $0.01 short of analyst targets.

Earnings rose 19% year over year, but that stock chart proves that investors expected more out of the virtual computing leader.

What's wrong?

Analysts were disappointed by the lack of clarity for 2013. Rackspace didn't offer any guidance on revenue or earnings targets, and the expected capital expenses are actually trending down from 2012 levels -- hardly a sign of rambunctious growth that would require large infrastructure improvements.

The company presented Staples as a significant new customer, but didn't provide any detail on the size of that deal. Chances are that the contract wasn't very impressive, because Staples didn't issue any press releases boasting efficiencies or cost savings from a new cloud-based IT platform. Cloud customers are prone to doing that when the upgrade really changes the game.

Uncertainty makes investors nervous, and for good reason. You shouldn't invest in black boxes where you have no idea what to expect.

Numbers don't tell the whole story

However, Rackspace is one of those high-growth opportunities where it's incredibly difficult to nail down targets to the last nickel. I think it pays off to consider the larger narrative here.

CEO Lanham Napier called 2012 "a year of execution and rebuilding -- a year spent in the lab" as Rackspace adopted the brand-new OpenStack infrastructure platform. By contrast, "2013 will be transformational for Rackspace," Napier said. "We will step up and lead the Open Cloud movement while laying the foundation for massive growth ahead."

He also zinged cloud rivals Amazon.com and VMware for representing an obsolete way of thinking. "Amazon and VMware embraced a legacy model of using proprietary technology to lock in their customers," he said. And now Rackspace finds that customers are looking for a new way of doing business in the cloud, with open standards and fewer proprietary systems. The sea change should start to play out this year, with the real payoff to come in 2014 and beyond.

What's next?

I'm very happy with my bullish CAPScall on Rackspace right now. Even after Wednesday's massive drop, it's still one of the best performers on my CAPS scorecard -- and I truly believe that the best is yet to come. If you didn't have a thumbs-up rating on Rackspace already, this could be the perfect time to get one started.

In fact, I just might put some real money in Rackspace to take advantage of this surprising buy-in discount. If I go there, I'll clue you in as soon as our Foolish disclosure policy lets me. Stay tuned.

The amount of data we store every year is growing by a mind-boggling 60% annually! To make sense of this trend and pick out a winner, The Motley Fool has compiled a new report called "The Only Stock You Need to Profit From the NEW Technology Revolution." The report highlights a company that has gained 300% since first recommended by Fool analysts but still has plenty of room left to run. Thousands have requested access to this special free report, and now you can access it today at no cost. To get instant access to the name of this company transforming the IT industry, click here -- it's free.

The article Should You Buy or Sell Rackspace Today? originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Amazon.com, VMware, and Staples. Motley Fool newsletter services have recommended buying shares of Amazon.com, Rackspace Hosting, and VMware. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.