Will High Expectations Knock Dillard's Off-Course?

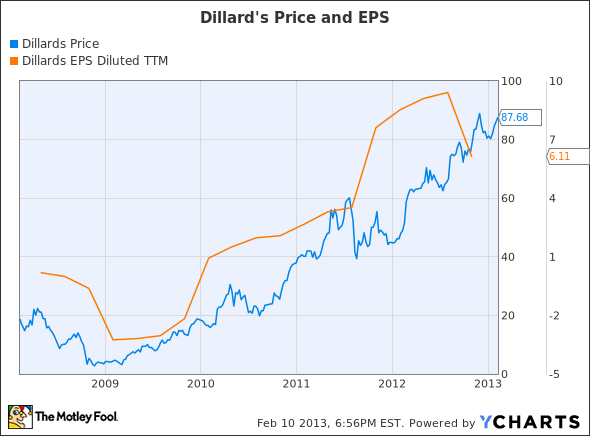

Department store operator Dillard's has made a major comeback since the Great Recession. The company's EPS and share price have both hit all-time highs recently; indeed, Dillard's Friday closing price of $87.68 represented a new all-time high after adjusting for a recent special dividend.

Dillard's 5-Year EPS and Share Price Chart, data by YCharts.

Analysts have high expectations for Dillard's over the next year, but recent market and industry trends could make it difficult for the company to meet these expectations. Since Dillard's no longer provides monthly sales updates, investors need to "read between the lines" to understand where sales and earnings are likely headed in the future.

Near-term sales growth could disappoint

Analysts currently expect fourth-quarter sales growth of 8.6% at Dillard's. This figure is boosted somewhat by the existence of an extra week in the current fiscal year. On a comparable-store sales basis (which excludes the extra week, as well as the impact of store closings), this translates to growth of approximately 5.5% to 6%. This is slightly better than the 5% comparable-store sales growth Dillard's recorded in the third quarter.

This projection seems overly aggressive. The retail sector as a whole saw very slow growth this past holiday season, with luxury retailers faring the best. The primary culprit seems to have been consumer uncertainty about the looming fiscal cliff. Macy's, which is Dillard's closest competitor, saw a fourth-quarter comparable-store sales increase of 3.9%. Kohl's, which is somewhat down-market from Dillard's, reported a comparable-store sales gain of just 1.9% for the quarter, while Nordstrom (a more upscale chain) reported a 6.3% increase. The performance of these competitors suggests that Dillard's is likely to see comparable-store sales growth of only 4%.

2013 could be tough

Moreover, Dillard's could have trouble repeating its 2012 successes in 2013. Dillard's, along with many other department stores, benefited from upheaval at competitor J.C. Penney over the past year. Analysts estimate that when all is said and done, J.C. Penney will have lost $4 billion of sales in the just-ended fiscal year 2012. All of J.C. Penney's competitors (including Dillard's) have benefited to some extent from Penney's woes.

However, J.C. Penney CEO Ron Johnson recently announced that the company will bring back sales this year. While J.C. Penney's sales will not rebound to 2011 levels, the company could regain some market share this year as the return of promotions draws in more shoppers. J.C. Penney is also looking to move up-market (and thus into heavier competition with Dillard's) by adding more fashion-oriented brands. This increase in competition from J.C. Penney could put pressure on sales growth at Dillard's and other mid-to-upscale competitors like Macy's and Nordstrom.

Last, the 2013 consumer spending environment will probably be sluggish. January consumer confidence was weaker than expected, and the 2% payroll tax hike that went into effect last month will have a significant impact on disposable income for many Americans. Even wealthier Dillard's customers may look to cut back on spending this year, with the top income tax bracket returning to 39.6%. As a result, Dillard's could have trouble meeting the market's lofty expectations in 2013.

Learn more

Will 2013 be the year that J.C. Penney comes back to eat Dillard's lunch? Or will J.C. Penney's tailspin continue? Investors wondering whether J.C. Penney is a buy today are invited to claim a copy of The Motley Fool's must-read report on the company. Learn everything you need to know about JCP's turnaround -- or lack thereof -- and as a bonus, you'll receive a full year of expert guidance and updates as key news develops. Simply click here now for instant access.

The article Will High Expectations Knock Dillard's Off-Course? originally appeared on Fool.com.

Fool contributor Adam Levine-Weinberg is short shares of Dillard's. The Motley Fool owns shares of Dillard's. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.