Why Activision Shares (Finally) Jumped

Something unusual happened last week. Shares of Activision Blizzard actually rose after the company beat the Street's forecast on revenue and profits.

The stock rallied by more than 11% on the news that fourth-quarter earnings were $0.78 a share, or about a nickel better than analysts were expecting. Adjusted revenue was also surprisingly high, coming in at $2.60 billion.

The jump in share price might have made long-term Activision shareholders the most surprised group out there. Activision was just being consistent, after all. Before last week's release, the company had trounced earnings expectations in each of the past three quarters: by 88%, 67%, and 50% more than Wall Street estimates. And yet the market responded with a yawn. Most recently, on Nov. 8, investors reacted to the company's third-quarter report, which included nearly twice the expected profits and a boost to Activision's full-year outlook. Shares closed 4% lower on the day.

So what was different this time? I don't claim to know why the market does what it does on any given day. But I did see some good reasons for investors to cheer the results.

The hits keep on coming

First, Activision has a genuine hit on its hands in the Skylanders franchise. And hits are critical in an industry that's seeing overall sales decline but increasing sales results for the top gaming titles. More and more, results are being driven by just a few blockbuster franchises.

Skylanders is off to a quick start in becoming one of those rainmakers. Sales already passed $1 billion, just 15 months after the game's introduction. Activision's results show the power of attaching a successful retail component to digital gaming. To date, over 100 million Skylanders toys have been sold globally.

That success has caught the eye of competitors. Disney plans to enter the category this summer with a new game called Infinity. The game promises to pair console gaming with characters from Disney's deep intellectual property catalog, and from more modern Pixar creations. Activision's challenge is to stay ahead of the pack as competition heats up. That's why it's moving the target with a new innovation, which allows for gamers to interchange parts on their toy characters, injecting loads of new variety into gameplay.

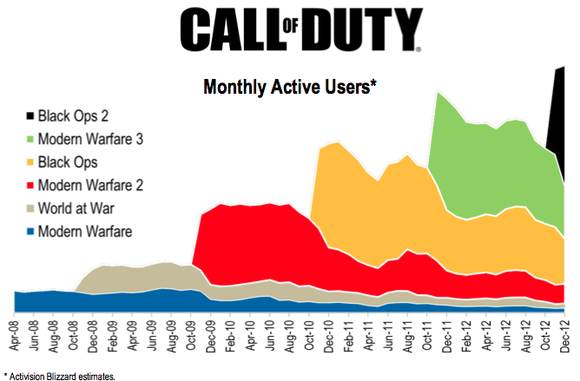

Of course, Activision's results were also driven by its more mature franchises. Diablo III was a big success, breaking PC sales records by booking over 12 million copies sold. And the Call of Duty series continued its four-year march of higher total monthly active users.

Source: Activision investor relations.

More shareholder return

Second, investors may be anticipating more cash from Activision. The company isn't skittish about returning cash to shareholders. Since 2009, it has spent more than $3.6 billion on stock repurchases and dividends. But it looks like there may be even higher returns ahead. Activision raised its annual dividend by a penny last week, to $0.19 a share. But it also said this about plans for deploying its hefty operating cash flow: "The company is considering or may consider during 2013, substantial stock repurchases, dividends, acquisitions, licensing or other non-ordinary course transactions, and significant debt financings relating thereto."

Sure, the potential for new loans isn't usually cause for celebration. But Activision's balance sheet is debt-free right now, while rivals like Electronic Arts have taken advantage of low interest rates to bulk up on cash for acquisitions and other purposes. At today's rates, it might make sense for Activision to take out some loans as it prepares to navigate the tricky move to the next generation of gaming consoles and devices.

Now what?

The rising development costs that will come with that transition is just one of the risks Activision faces this year. Softer-than-expected sales of Nintendo's Wii U system might end up crimping sales of Skylanders titles. And the big success of Diablo III last year will make for tough comparisons against 2012. Sure enough, the company has called for both revenue and profits to fall in 2013.

But that outlook doesn't include any of the potential impact from Activision's product pipeline. The next games on deck include a mix of brand-new intellectual property -- like its collaboration with Bungie on a new gaming universe -- and an extension of established brands, like Call of Duty Online in China.

Success with any of these titles could make for a surprisingly good year for Activision. And Wall Street might even notice.

Editor's note: A previous version of this article stated that Activision's dividend is paid quarterly. The Fool regrets the error.

While Activision and Microsoft have been taking the headlines when it comes to console gaming, Fools following the gaming sector would do well to also keep tabs on Electronic Arts. We can help. Our new special report breaks down the risks and opportunities facing the company to help you decide if EA is right for your portfolio. Click here to get your copy now and we'll throw in a year of free quarterly updates as news breaks.

The article Why Activision Shares (Finally) Jumped originally appeared on Fool.com.

Fool contributor Demitrios Kalogeropoulos owns shares of Walt Disney and Activision Blizzard. The Motley Fool recommends Activision Blizzard, Nintendo, and Walt Disney. The Motley Fool owns shares of Activision Blizzard and Walt Disney. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.