How Dividends Change the Game for Disney

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small differences in the short term add up to massive divergence over decades. In the end, the biggest winners don't always deliver the fattest share-price returns.

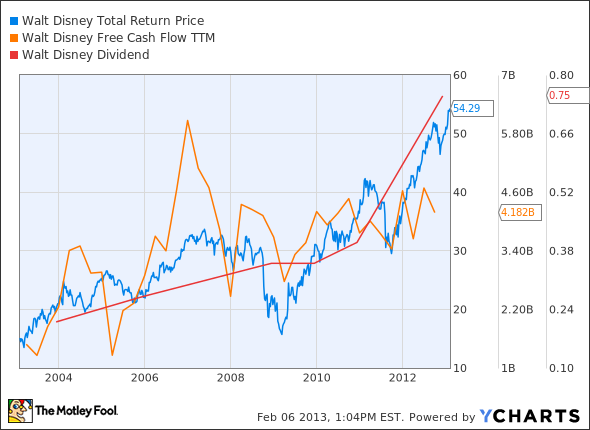

Take entertainment giant Walt Disney , for example. The longtime Dow Jones Industrial Average component has absolutely crushed its Dow peers over the last decade, any way you slice it. But if you're not reinvesting your Disney dividends in more stock, you're leaving a significant pile of money on the table.

The dividend-based bonus return may not nook like much in isolation. Plain old share-price gains should be enough to satisfy any investor here, right?

But then you're not seeing the bigger picture. Disney has a long history of making game-changing acquisitions, followed by large payout increases -- and rising share prices. You can almost set a clock by these tightly related trends.

Look at this chart, keeping in mind that Disney bought Pixar in 2006 and Marvel in 2009.

DIS Total Return Price data by YCharts.

Would you bet against the Lucasfilm deal powering another big dividend boost and share price jump as the Star Wars portfolio takes shape? I sure wouldn't. It's in Disney's DNA to share its deal-powered wealth with investors.

It's easy to forget that Walt Disney is more than just the House of the Mouse. True, Disney amusement parks around the world hosted more than 121 million guests in 2011. But from its vast catalog of characters to its monster collection of media networks, much of Disney's allure for investors lies in its diversity, and The Motley Fool's new premium research report lays out the case for investing in Disney today. This report includes the key items investors must watch, as well as the opportunities and threats the company faces going forward. We're also providing a full year of regular analyst updates as news develops, so don't miss out -- simply click here now to claim your copy today.

The article How Dividends Change the Game for Disney originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Walt Disney. Motley Fool newsletter services have recommended buying shares of Walt Disney. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.