Should You Buy Into This Dow Dividend Dynamo?

The Dow Jones Industrial Average is taking a breather after its recent bullish charge. The blue-chip index is down 0.9% at midday, hurt by a cocktail of worrisome news on Mediterranean economies and a surprising pullback on rising oil prices. Of the 30 Dow components, 29 are in the red right now.

Amid the carnage, you'll find pharma giant Merck dropping 2%. That's the second-steepest fall on the Dow today. The macroeconomic worries were underscored by a couple of downgrades by analysts citing risks in Merck's drug development pipeline.

But pipeline risks are nothing new. Biotech and pharmaceuticals investors are used to dealing with the FDA wild card, and Merck's drug-approval uncertainty is always priced into the stock.

Buy Merck today, and you'll lock in a stellar 4.1% dividend yield. That's richer than fellow Dow members Johnson & Johnson, at 3.3%, and Pfizer, at 3.5%. In fact, Merck sports the fourth-richest yield on the Dow today, behind only the telecom cash machines and drastically undervalued semiconductor titanIntel. I have personally found Intel's yield irresistible, and Merck isn't far behind.

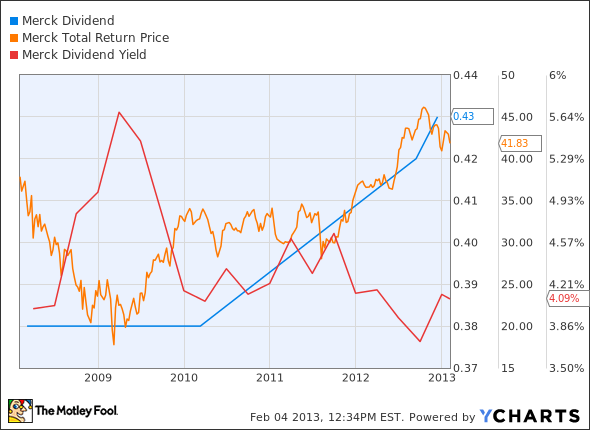

And that's not all. The quarterly payouts were frozen at $0.38 per share for seven years, starting in 2004. The dividend has been boosted twice in the last five quarters and now sits at $0.43 per share, per quarter.

MRK Dividend data by YCharts.

This willingness to raise the payouts speaks volumes about Merck's confidence in the current product pipeline.

Long story short, Merck's dividend looks rich today but is likely to head even higher over the years. Investors with a yen for income-generation would do well to take a closer look at exploiting this opportunity.

For nearly 100 years, Merck's cutting-edge research has led to a number of medical breakthroughs. Today, however, this pharma stalwart is staring down a steep patent cliff and facing generic competition for its top-selling drug. Will Merck crumble under its own weight, or will it continue to pay dividends to investors for another century? To find out if this pharma giant has the stamina to keep its Bunsen burners alight, grab your copy of our brand-new premium research report today. Our senior biotech analyst, Brian Orelli, Ph.D., walks you through both the opportunities and the threats facing Merck, and the report comes with a full 12 months of updates. Claim your copy now by clicking here.

The article Should You Buy Into This Dow Dividend Dynamo? originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Intel, but he holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Intel and Johnson & Johnson. Motley Fool newsletter services have recommended buying shares of Intel and Johnson & Johnson. Motley Fool newsletter services have recommended buying calls on Johnson & Johnson. Motley Fool newsletter services have recommended writing puts on Intel. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.