Dominion Earnings Report: Can Natural Gas Boost Your Profits?

Dominion Resources reported earnings Thursday, meeting the mark on earnings but underwhelming sales estimates. This utility is changing rapidly, and investors need to be more aware than ever of where Dominion's headed. Let's take a look at this quarter's results to see what's in store for this company's future.

Number crunching

On the top line, Dominion flatlined. The utility pulled in $3.17 billion in sales, mirroring its 2011 results. Wall Street had expected $3.74 billion, an 18% increase over Q4 2011's revenue.

Net income doubled to $400 million, equivalent to $0.69 per share. With market analyst expectations of $0.69 EPS, Dominion delivered on its bottom line. Its natural gas division added $0.06 more than in Q4 2011, while the company's regulated utility and other generation subsidiaries each contributed an additional $0.03 over last year's fourth quarter.

For Dominion's third quarter, the utility's income dropped 47% compared to 2011, contributing to its 5% miss on Wall Street's estimated $0.97 EPS. At the time, CEO Thomas Farrell expected his company's Q4 earnings to increase 20% year over year.

For 2012 overall, the company's operating earnings came in at $3.05, below Dominion's $3.10-$3.35 guidance. CFO Mark McGettrick cites mild weather as the main reason for the slump, estimating that Dominion would've achieved $3.35 EPS and 7% growth with "normal weather."

Looking ahead, Dominion is sticking to its previous $0.80-$0.95 EPS guidance for Q1 2013. The company expects its new projects to start paying off, despite higher operating and maintenance costs and lower contributions from its retail division.

Position to transition

Dominion is in a transitional stage. Its main accomplishments for 2012 include the completion and construction of a variety of major capital projects. The utility brought a new $1.8 billion "clean coal" facility online in July after four years of construction, and broke ground on a 1,329 MW combined cycle plant in March. According to its 2012 annual report, Dominion's generation subsidiaries have just over 26,000 total MW capacity, comprised of the following fuels:

Source: Author, data from Dominion 10-K

As Dominion makes its retreat from coal, a bet on Dominion is a bet on conversion. The utility is busy cutting its coal consumption through sell-offs, switching over to cheaper and ostensibly cleaner fuel sources for future generation. It began conversion of three power stations from coal to biomass in the last year, which should be operational by the end of 2013.

With heavy roots in Virginia, Dominion has been busy expanding its natural gas infrastructure to connect Appalachia to other pipelines. For 2012, its $1.5 billion midstream joint venture with Caiman Energy was the most profitable division of the company.

Source: Dominion Q4 Earnings Presentation

The company is also working on cultivating a liquefied natural gas export business through its Cove Point facility in Maryland. It's still awaiting a Department of Energy license to export to non-Free Trade Agreement countries, but signs point to imminent approval.

Digging deeper

Top-line sales reflect a growth potential for Dominion that may be dwindling for other companies. NextEra Energy just reported a 13% drop in Q4 revenue, and a new report suggests that nationwide electricity sales will grow at a miserly 0.58% compound annual growth rate over the next decade.

If you're investing in Dominion, you're investing in its natural gas potential. The company is trading at a premium compared to most other utilities, but it promises much more than an income earner (albeit without the fat dividend):

Company | Price-to-Earnings | Price-to-Sales | Price-to-Cash Flow |

|---|---|---|---|

Dominion | 26.2 | 2.4 | 14.7 |

Atlantic Power | - | 2.5 | 11.0 |

Exelon | 16.8 | 1.3 | 8.4 |

FirstEnergy | 16.0 | 1.1 | 6.0 |

National Grid | 11.0 | 1.9 | 7.4 |

Source: e*trade.com

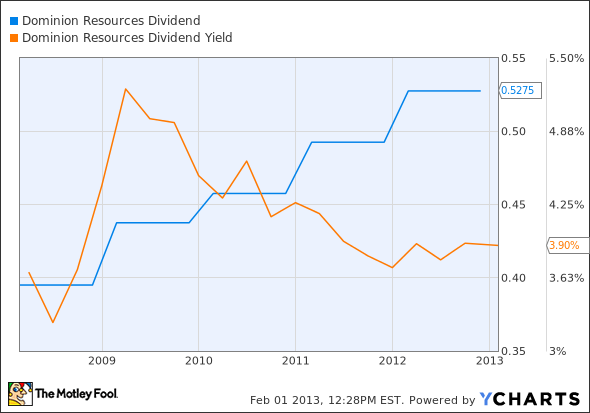

The company has increased its dividend at an average annual rate of 6.7% over the past five years, but its yield is down to 3.9% since the Great Recession.

D Dividend data by YCharts

Foolish bottom line

Dominion's fourth quarter hit the mark, which is a lot to ask for considering investors' high hopes for this company's future. With its stock price up 88% since the lows of 2009, this utility's subsidiaries are straddling a fine line between value and growth.

For those looking to swallow some risk and bet big on natural gas, Dominion offers (currently) steady income and an alternative from energy pure-plays like Chesapeake Energy. But natural gas prices, domestic policy, and liquid natural gas export potential will make or break this utility, and no amount of effective management or margin thickening will influence those issues.

As the nation moves increasingly toward clean energy, one company in this space that is perfectly positioned to capitalize on having the largest nuclear fleet in North America is Exelon. This strength combined with an increased focus on renewable energy, along with its recent merger with Constellation, puts Exelon and its best-in-class dividend on a short list of top utilities. To determine if Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

The article Dominion Earnings Report: Can Natural Gas Boost Your Profits? originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool recommends Dominion Resources, Exelon, and National Grid plc (ADR). The Motley Fool has the following options: Long Jan 2014 $20 Calls on Chesapeake Energy, Long Jan 2014 $30 Calls on Chesapeake Energy, and Short Jan 2014 $15 Puts on Chesapeake Energy. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.