The Dow Isn't Taking AT&T's Call

The Dow is down slightly this afternoon after this morning's economic releases proved mixed for stocks. As of 1:15 p.m. EST, the Dow Jones Industrial Average is down 23 points, or 0.17%, while the S&P 500 is down about two points to 1,500.

There were four U.S. economic releases this morning.

New initial unemployment claims | Jan. 19 to Jan. 26 | 368,000 | 330,000 |

Employment Cost Index | Q4 2012 | 0.5% | 0.4% |

Personal income | December | 2.6% | 1% |

Consumer spending | December | 0.2% | 0.4% |

Source: MarketWatch U.S. Economic Calendar.

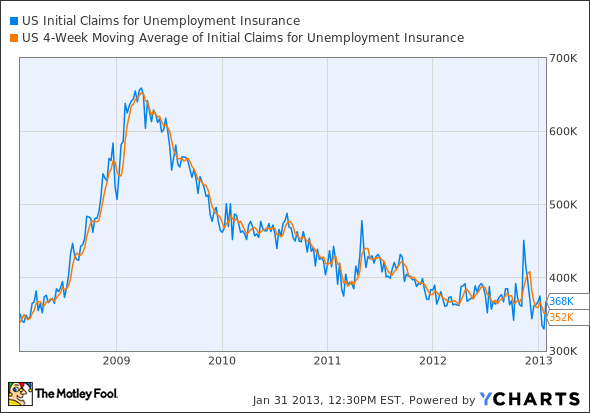

Earlier today, the Department of Labor reported that new initial unemployment claims rose to 368,000 -- roughly the average for 2012. That's far above last week's 330,000 -- a five-year low -- and above analyst expectations of 355,000. This week's jump moves the four-week moving average up just 250 to 352,000, which is still near a five-year low.

US Initial Claims for Unemployment Insurance data by YCharts.

The jobs market has been relatively flat over the past year, with average new initial unemployment claims of 365,000 to 370,000. Yesterday, payroll processor ADP reported that the U.S. added 192,000 private-sector jobs in January, which was above analyst expectations. The Department of Labor releases its monthly jobs report tomorrow.

The second economic release today was the Department of Labor's Employment Cost Index, which rose 0.5% in the fourth quarter of 2012. The Employment Cost Index measures the cost of compensation for nonmilitary workers. Wages make up 70% of the index, while benefits compose the remainder. This past quarter, wages rose 0.3% and compensation rose 0.6% for a total rise of 0.5%, in line with analyst expectations. For the full year of 2012, the ECI rose 1.9%, roughly unchanged from 2011's two percent rise.

The third economic release today was from the Department of Commerce, which reported that personal income rose 2.6% in December. That's far above both November's 1% growth and analyst expectations of 0.9% growth. The biggest factor was a 34% jump in dividends, attributable to companies paying forward-planned dividends or special dividends before the expected jump in the dividend tax rate. Personal income is expected to drop in January as the 50% hike of the payroll tax takes a bite out of consumers' wallets.

The fourth and final economic release was consumer spending, which rose a seasonally adjusted 0.2% in December. That was in line with analyst expectations but below November's 0.4% growth. The decrease in consumer spending could have been expected, as Wednesday's GDP report showed a slight contraction in the economy.

Today's Dow leader

Today's Dow leader is AT&T up 1.3% on no real news. Last week AT&T reported fourth-quarter earnings that missed analyst expectations. Earnings per share excluding one-time items were $0.44, slightly below analyst expectations of $0.45 per share Revenue was $32.6 billion, beating analyst expectations of $32.2 billion. The day after AT&T reported earnings, the company announced a deal to acquire spectrum from Verizon for $1.9 billion. AT&T has been under pressure recently, as the company has an underfunded pension that investors are finally taking note of. This, combined with high subsidies for smartphones, has been challenging for AT&T.

The article The Dow Isn't Taking AT&T's Call originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.