Royal Gold's Record Revenue Rundown

When a stock can retreat 25% from a recent peak, and still remain one of the best-performing investment vehicles in its sector, the observant Fool knows to look for opportunity in the pullback.

Royal Gold reported record royalty revenue of $79.9 million on Thursday for its fiscal second quarter of 2013, along with record adjusted EBITDA of $73.4 million. At 92% of revenues, that's one seriously robust EBITDA margin that speaks to the perennial beauty of the underlying royalty and streaming business models. I have marveled at the unrivaled profitability of its popular counterpart in the silver industry, but not even that serial outperformer can claim to have bested the five-year trailing return of Royal Gold.

Thanks principally to impressive production growth from the Andacollo copper mine -- where operator Teck Resources performed some valuable tinkering through de-bottlenecking and plant optimization efforts -- Royal Gold delivered 16% growth in net earnings atop only a 2% increase in the average realized gold price. Andacollo alone accounted for 30% of the company's royalty revenues, which underscores the significance of looming projects like Thompson Creek Metals' Mt. Milligan and Barrick Gold's Pascua-Lama to the diversification of its revenue stream.

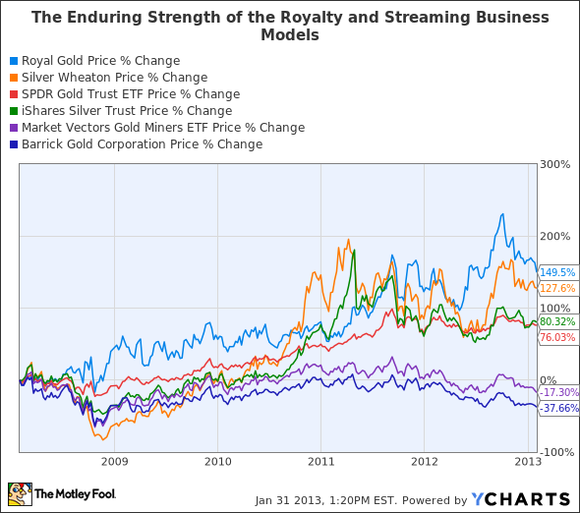

Along with larger rival Franco-Nevada, and noteworthy up-and-comerSandstorm Gold , the small group of royalty and metal-streaming plays have certainly proven their mettle with their easy outperformance (over the trailing-five-year period) of both the underlying metal prices and the relevant mining shares. Have a look at the following five-year chart, which confirms that Royal Gold's shares have provided a truly superior vehicle for gold exposure, even to the overly popular SPDR Gold Trust .

Within that longer-term context, I encourage Fools to view the recent 25% pullback in the shares of Royal Gold as the sort of gold investment opportunity that doesn't come along every day. While some additional near-term weakness is conceivable -- particularly if Barrick were to reveal any further delay to its problem-plagued Pascua-Lama project when the miner provides a project update in mid-February -- Royal Gold's stock near $75 per share shows far more upside promise than downside risk to this long-term oriented Fool.

Goldcorp is one of the leading players in the gold mining market. For the last several years, investors have been the beneficiaries of several successful acquisitions and strong organic growth. Goldcorp's low-cost production of one of the most sought-after metals in the world continues to make them an attractive choice for long-term investors. Click here for our detailed report to discover more about this mining specialist.

The article Royal Gold's Record Revenue Rundown originally appeared on Fool.com.

Fool contributor Christopher Barker owns shares of Sandstorm Gold and Teck Resources Limited (USA). The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.