Kinder Morgan Makes Another Buy

Kinder Morgan Energy Partners L.P. (NYSE: KMP) announced late last night that it has reached a definitive agreement to acquire midstream company Copano Energy LLC (NASDAQ: CPNO) in a transaction worth a total of $5 billion, including Copano's debt. The transaction will be straight-up swap of common units in which Copano shareholders will receive 0.4563 common units of KMP for each Copano common unit.

At last night's closing price, Copano is valued at $40.91 per share, a premium of 23.5%. The deal is expected to close in the third quarter.

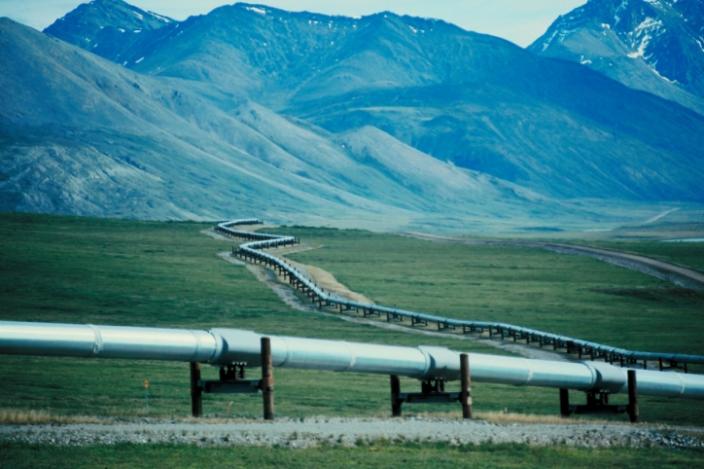

Copano owns natural gas gathering systems, processing and treating plants in Texas, Oklahoma and Wyoming. The company also has a stake in or owns 6,900 miles of transportation pipelines. By this acquisition, Kinder Morgan gains access to the Eagle Ford shale play, as well as the Mississippi Lime play in Oklahoma.

The general partner of KMP will forgo a portion of its incremental incentive distributions for the next several years in order to help fund distributions to limited partners. KMP said the transaction will be modestly accretive to the company in 2013 and will add about $0.10 per unit for a five-year period beginning in 2014.

Copano's shares closed at $33.13 last night and are trading at $40.50 in the premarket this morning. The stock's 52-week range is $24.24 to $38.03.

Kinder Morgan's shares are inactive in the premarket, having closed at $89.66 last night in a 52-week range of $74.15 to $90.60.

Filed under: 24/7 Wall St. Wire, Commodities, Mergers & Acquisitions, Mergers and Buy Outs, Oil & Gas Tagged: CPNO, KMP