How Dividends Change the Game for This High-Yielder

The wealth-building power of compound interest will never cease to amaze me.

It's a story of patience and attention to detail, where small differences in short timescales add up to massive divergence over decades. In the end, the biggest winners don't always deliver the fattest share-price returns.

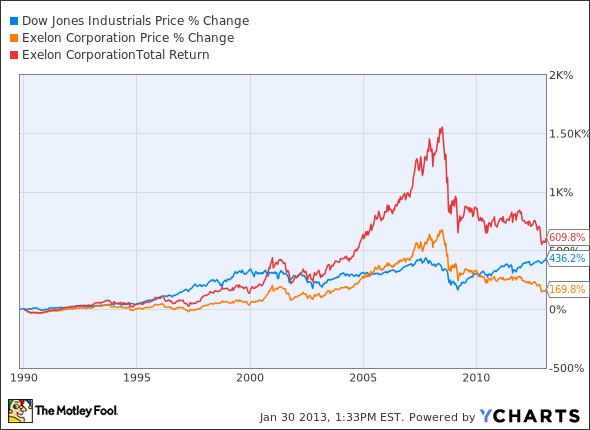

Consider the case of diversified energy guru Exelon . The stock has seen its share of ups and downs over the years, but has underperformed the Dow Jones Industrial Average index in the long term.

But the story changes dramatically once you take Exelon's generous dividend history into consideration. The company hasn't always been a model of dividend aristocracy, but Exelon nevertheless shares an impressive amount of wealth directly with its shareholders. Right now, Exelon's 6.7% yield is richer than every single one of the Dow's 30 high-class dividend payers.

EXC Dividend data by YCharts.

These payouts have made a massive difference to total returns on your investment. If you reinvested every penny of Exelon's dividends into more shares, you'd be crushing the Dow by a wide margin.

There are other reasons to invest in Exelon over traditional oil-based energy stocks, too.

Oil-focused investments have been outperforming Exelon in recent years, but the tide may turn again. In fact, I'm pretty sure it will. You see, Exelon is among the nation's largest providers of green energy, including a major investment in nuclear power plants.

At the moment, Exelon's yield is artificially high and share prices too low because investors worry about a long-term slump in natural gas prices. The same dynamics cause the exact opposite effect on natural gas producers, since Exelon is on the consumer's side of the equation. That's why Exelon shares look so cheap these days while ExxonMobil and Chevron command premium prices -- but subpar dividends, historically speaking.

If you're looking for a solid large-cap dividend play today, all of these facts would suggest that you should skip over the expensive Dow components I just mentioned but dig deeper into Exelon instead. You don't have to drill for oil and gas to be a solid cash machine in the energy sector.

As the nation moves increasingly toward clean energy, Exelon is perfectly positioned to capitalize on having the largest nuclear fleet in North America. Combine this strength with an increased focus on renewable energy, and EXC's recent merger with Constellation places Exelon and its best-in-class dividend on a short list of top utilities. To determine whether Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

The article How Dividends Change the Game for This High-Yielder originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.Motley Fool newsletter services have recommended buying shares of and writing puts on Exelon. They've also recommended Chevron. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.