Boeing Tries to Thrust the Dow Into Flight

The Dow is basically unchanged this afternoon while it waits for the Federal Open Market Committee's announcement at 2:15 p.m. EST and investors digest this morning's mixed economic news. As of 1:20 p.m. EST, the Dow Jones Industrial Average has barely managed to gain a point, while the S&P 500 is down about one point.

There were two U.S. economic releases this morning.

Report | Period | Result | Previous |

|---|---|---|---|

ADP private-sector jobs report | January | 192,000 | 185,000 |

GDP advance report | Q4 2012 | (0.1%) | 3.1% |

Source: MarketWatch U.S. Economic Calendar.

This morning, payroll processor ADP reported that the U.S. added 192,000 private-sector jobs in January. That's above last month's 185,000 and analyst expectations of 173,000 jobs. ADP's private-sector jobs report always comes out two days before the government's nonfarm-payroll report, which includes both public and private jobs numbers. While ADP's report only includes private-sector jobs, it can be a useful indicator of the overall jobs market.

ADP Change in Nonfarm Payrolls data by YCharts.

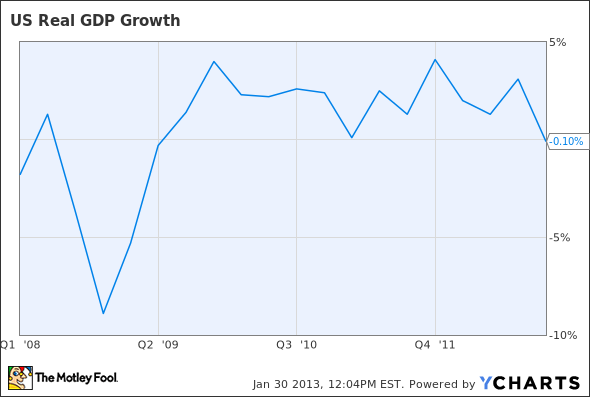

In other news, the Department of Commerce's Bureau of Economic Analysis reported that GDP contracted by an annualized 0.1% in the fourth quarter of 2012, down precipitously from Q3's rate of 3.1% annualized growth.

US Real GDP Growth data by YCharts.

Analysts had expected growth of 1% in the quarter. It should be noted that the BEA estimates GDP three times for each quarter. This release was the first estimate for Q4 2012, and subsequent estimates could vary as more data becomes available. The second estimate of Q4 GDP will come on Feb. 28.

The market is in a holding pattern as it waits for the Federal Reserve's Federal Open Market Committee statement at 2:15 p.m. EST. Fed watchers don't expect the Fed to make any changes to the current quantitative-easing measures, as it said at its last meeting that it would not change rates until the unemployment rate falls below 6.5%.

Today's Dow leader

Today's Dow leader is Boeing up 1.2% after reporting its fourth-quarter earnings. Boeing reported earnings per share of $1.28, beating analyst estimates of $1.19 and Estimize's wisdom-of-the-crowds estimate of $1.25. Revenue was up 14% to $22.3 billion, in line with analyst estimates.

Boeing has had a rough few weeks as the Federal Aviation Administration grounded Boeing's 787 Dreamliner over problems with its lithium battery. Boeing CEO Jim McNerney said in today's conference call that the company is diligently working to "restore confidence in the 787 and Boeing." He went on say, "It is important to reiterate that 787 production continues as planned, and we remain confident in the future of the program and the integrity, safety, and performance of the airplane."

With great opportunity comes great responsibility. For Boeing, which is a major player in a multitrillion-dollar market, the opportunity is massive. However, the company's execution problems and emerging competitors have investors wondering whether Boeing will live up to its shareholder responsibilities. In this premium research report, two of The Fool's best industrial-sector minds have collaborated to provide investors with the must-know info on Boeing. They'll be updating the report as key news hits, so be sure to claim a copy today by clicking here now.

The article Boeing Tries to Thrust the Dow Into Flight originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.