Is LeapFrog Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what LeapFrog's recent results tell us about its potential for future gains.

What the numbers tell you

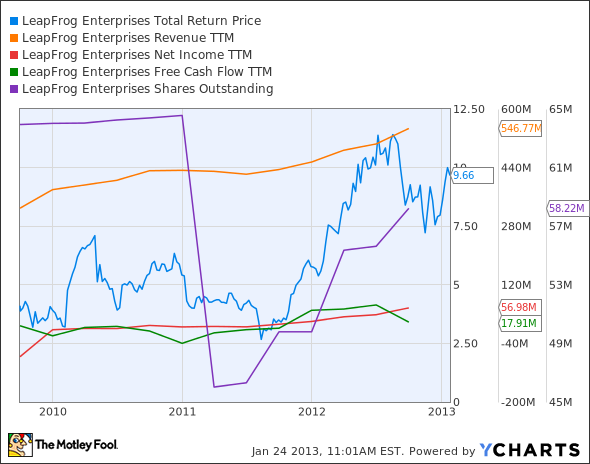

The graphs you're about to see tell LeapFrog's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much LeapFrog's free cash flow has grown in comparison with its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If LeapFrog's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is LeapFrog managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

By the numbers

Now, let's look at LeapFrog's key statistics:

LF Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 66.2% | Pass |

Improving profit margin | 235.2% | Pass |

Free cash flow growth > Net income growth | 120.1% vs. 174.5% | Fail |

Improving EPS | 169.4% | Pass |

Stock growth (+ 15%) < EPS growth | 135% vs. 169.4% | Pass |

Source: YCharts.

*Period begins at end of Q3 2009.

LF Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 156.7% | Pass |

Declining debt to equity | No debt | Pass |

Source: YCharts.

*Period begins at end of Q3 2009.

How we got here and where we're going

LeapFrog turns in a strong performance, missing one passing grade only by a technicality -- starting from negative income can skew the final percentage increase. If the company can maintain a similar track record in 2013, it's well within reason to expect a perfect score the next time we take a look at it. But will LeapFrog be able to sustain its momentum? Let's dig deeper.

We'll start with what proved to be LeapFrog's 52-week high, way back in July. At the time, LeapFrog was valued more highly than toymakers Mattel and Hasbro , which compete for "fun dollars" from parents looking to give their kids something to do. A focus on relatively low-cost electronic entertainment has been perfectly timed to capitalize on a shift from things like Barbies and board games to tablets and the apps therein. At the time, my fellow Fool Sean Williams noted that LeapFrog's forward P/E was higher than Mattel's or Hasbro's -- today, it's cheaper than both, both on a trailing and a forward basis.

Part of the weakness between then and now can be attributed to seasonality, increasing competition, and sky-high stock growth, which tamped down revenue growth expectations into single-digit territory even though the company's line of kid-friendly educationally focused tablets took three of the top four spots on NPD Group's best-selling holiday toys list.

The competitive issue is certainly the most prominent one, so let's focus on that. LeapFrog already does battle with Amazon.com and Apple in the tablet space, but its consistent advantage is both a lower price point and a more specialized experience. Well-heeled parents might prefer a $159 Kindle Fire or a $329 iPad Mini, but with median incomes stagnant and the job market still weak, there should be plenty of room for LeapFrog on the low end -- unless it gets more targeted competition, as was the case this fall, when Toys "R" Us unveiled a kid-friendly tab of its own.

While the Toys "R" Us tab is about twice as costly as LeapFrog's entry-level device, it still represents a threat, depending on how good its performance and app selection happen to be. What's more threatening is Amazon's dedication to continually slashing the prices on its low-cost Fires, which are already following a well-known trendl ine that pushes the cost of Amazon electronics lower and lower with each passing year. Right now, the baseline Fire is $159, down $40 from last year's introduction. Based on that rate of reduction, it might hit $129 by year-end, and then $99 at some point in 2014. It's still a bit costlier than the LeapPad, but there's certainly some appeal for a device that parents as well as kids can use.

Putting the pieces together

Today, LeapFrog has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

If you're interested in keeping tabs (get it?) on Amazon's growing influence on the world of low-cost tablets, The Motley Fool has a dedicated premium research service to help you. Our tech analysts stay on top of the e-retailer's big moves, offering you unbiased reports and regular updates for a full year. If you're interested in Amazon, either as an investment or as a competitor to your investments, you owe it to yourself to subscribe today. Simply click here to get started.

Keep track of LeapFrog by adding it to your free stock Watchlist.

The article Is LeapFrog Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter, @TMFBiggles, for more news and insights.The Motley Fool recommends and owns shares of Amazon.com, Apple, Hasbro, LeapFrog Enterprises, and Mattel. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.