The Short Heard 'Round the World

You probably learned in American history class about the "shot heard 'round the world," but what about the short heard 'round the world? Let the textbooks duly note that on Dec. 19, 2012, Bill Ackman and his Pershing Square Capital Management hedge fund fired off the short that rocked the investing world -- a $1 billion bet against weight loss and nutritional supplement seller Herbalife . This massive short-sell also set off what has now become a full-blown war of the hedge funds. Let's look at the history and potential future of this epic battle over Herbalife.

Mustering the troops

This war officially started on Dec. 19 with Bill Ackman's allegations that Herbalife was a "pyramid scheme," but the battle had actually quietly started months before when he first began shorting the stock. Shares of the company dropped nearly 15% soon after his public announcement disparaging Herbalife's business model. Herbalife CEO Michael Johnson took to the airwaves later in the day to vehemently deny Ackman's charges, accusing the hedge fund manager of "blatant market manipulation."

Ackman followed up on Dec. 20 with a presentation detailing his specific issues related to Herbalife. The next day, the company announced that it would respond to all of the allegations with an analyst day the week of Jan. 7. This event was ultimately held on Jan. 10.

In an intriguing twist, the skirmish between Pershing Square and Herbalife erupted into a much larger conflict. Robert Chapman with hedge fund Chapman Capital Partners went public with his skepticism about Ackman's position. Daniel Loeb's hedge fund, Third Point LLC, bought an 8.2% stake in Herbalife. Loeb directly challenged Ackman's assertions, calling them "preposterous."

Bronte Capital's John Hempton, no fan of Herbalife, stated that Ackman "did not check the facts." Just this week, billionaire Carl Icahn announced that he bought a small position in Herbalife. If Honey Boo Boo ran a hedge fund, she'd probably be taking sides as well.

Battle lines

How does Bill Ackman back up his allegations that Herbalife is a pyramid scheme? In a nutshell, he says that the company's distributors receive more money from recruiting other distributors than they do from selling Herbalife's products.

Ackman maintains that Herbalife prices its products to be much more expensive than rivals. His premise is that the company's intention is to inflate retail sales to look larger than recruiting rewards paid to distributors. He also says that Herbalife lowers its actual recruiting reward dollars by reflecting vacations and other promotions that are perks for top recruiters in the selling, general, and administration expenses line item.

The Pershing Square boss accuses Herbalife of selling "business opportunity" more than products. Of the products that Herbalife does sell, Ackman says that most of the sales are to distributors with few outside customers. He also states that Herbalife's growth numbers are misleading and unsustainable because they are based on a "pop and drop" approach that depends primarily on moving to new markets for growth to hide declines in established markets.

Herbalife counters that Formula 1's price per serving is actually in the middle of major rivals' prices (although no response is given to overpricing allegations about its other products). The company points to what it perceives as several flaws in Ackman's argument about its financial reporting of sales information. Herbalife categorically denies that it pays distributors to recruit others.

Regarding Ackman's claim that there are few outside customers, Herbalife cites market research performed by Lieberman Research that found that 92% of the company's customers are outside of its distributor network. The company notes that this research showed that most distributors joined the network primarily to obtain discounts for their own consumption. Herbalife responds to the "pop and drop" accusations with the observation that only 8% of its 2012 sales as of September were from markets that the company entered less than 10 years ago.

Casualties and spoils of war

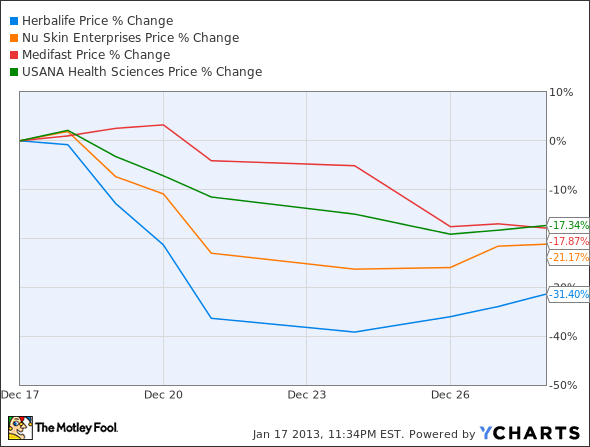

Every war has its casualties. In this case, some multi-level marketers other than Herbalife were affected over the short term by the pyramid scheme allegations.

Data by YCharts.

Medifast and Usana , both of which sell weight loss programs via distributors, fell around 17% in the immediate aftermath. NuSkin , which markets anti-aging products, dropped even more.

If the war had ended in late December, Ackman would have been crowned the victor. However, as Herbalife and other notable investors refuted the allegations, shares for the company clawed their way back to move higher than levels reached prior to Ackman's attack.

Raging on

The war isn't over yet, though. Bill Ackman vows to fight on and thinks Herbalife shares will fall to zero. The New York Times reported on Jan. 9 that the SEC has opened an investigation of the company. Meanwhile, Herbalife continues to draw more supporters for its cause.

The shot heard 'round the world started a war that didn't end until eight years later. The war caused by the short heard 'round the world seems likely to rage on for quite a while, too.

Facing a battle of your own about what stocks to buy in 2013? Give peace a chance and see which stock The Motley Fool's chief investment officer has selected as his No. 1 stock for the next year. Find out which stock it is in our brand-new free report: "The Motley Fool's Top Stock for 2013." I invite you to take a copy, free for a limited time. Just click here to access the report and find out the name of this under-the-radar company.

The article The Short Heard 'Round the World originally appeared on Fool.com.

Fool contributor Keith Speights has no position in any stocks mentioned. The Motley Fool has the following options: Long Jan 2014 $50 Calls on Herbalife Ltd. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.