Disney Leads the Dow Higher Despite Bad Bank Earnings

The Dow Jones Industrial Average is overlooking bad earnings reports from Bank of America and Citigroup , choosing instead to celebrate today's positive economic reports. As of 1:35 p.m. EST, the Dow is up up 93 points, or 0.69%, to 13,605. The S&P 500 is up nine points, or 0.61%, to 1,482.

There were two economic releases this morning:

Report | Period | Result | Previous |

|---|---|---|---|

New initial unemployment claims | Jan. 5 to Jan. 12 | 335,000 | 372,000 |

Housing starts | December | 954,000 | 851,000 |

Source: MarketWatch U.S. Economic Calendar.

After reporting bad earnings, Bank of America is down 4.4% to $11.26, and Citigroup is down 3.2% to $41.12. Both banks were hamstrung by all sorts of "one-time" charges, including legal fees, mortgage writedowns, and foreclosure reviews, among many others. "One-time" charges have become the rule, rather than the exception, at many banks. Despite the bad earnings, Fool analyst John Maxfield still likes Bank of America and is preaching patience.

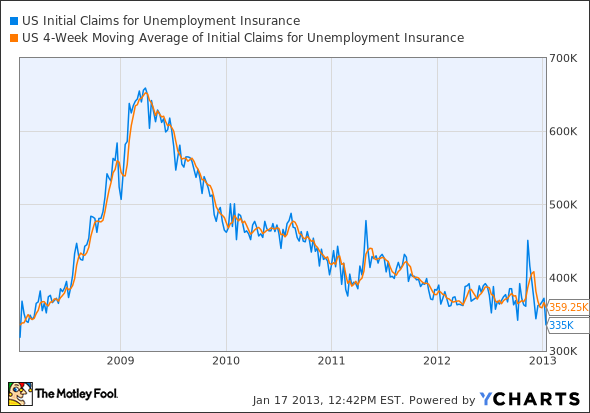

The Dow is overlooking the bad earnings from the banks and is instead focusing on today's economic releases. The first report was from the Department of Labor, which reported that new initial unemployment claims fell by 37,000 to 335,000. That's far below analyst expectations of 368,000. This week's low level brings the less volatile four-week average down by 6,750 to 359,250. That's roughly the average's lowest level since 2008.

Data by YCharts.

The second report was from the Department of Commerce, which reported that housing starts rose to an annual rate of 954,000. That is significantly above last month's rate of 851,000 and above analyst expectations of 883,000. The housing market strengthened throughout 2012, and that trend will hopefully continue through 2013.

Data by YCharts.

Given the mix of positive economic news and bad bank earnings, it's a bit of a surprise that the Dow is surging.

Today's Dow leader

Today's Dow leader is Disney , up 1.9%. Yesterday, Deutsche Bank reiterated its buy rating on Disney and upped its price target. It was also announced that AT&T and Disney had reached a deal to allow access Disney's entire content lineup on all of AT&T's offerings across TV, computers, smartphones, tablets, and gaming consoles. Disney's lineup includes Disney, ESPN, ABC, and all their related offerings.

It's easy to forget that Walt Disney is more than just the House of the Mouse. True, Disney amusement parks around the world hosted more than 121 million guests in 2011. But from its vast catalog of characters to its monster collection of media networks, much of Disney's allure for investors lies in its diversity, and The Motley Fool's new premium research report lays out the case for investing in Disney today. This report includes the key items investors must watch, as well as the opportunities and threats the company faces going forward. We're also providing a full year of regular analyst updates as news develops, so don't miss out -- simply click here now to claim your copy today.

The article Disney Leads the Dow Higher Despite Bad Bank Earnings originally appeared on Fool.com.

Dan Dzombakowns shares of Bank of America. He can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak.The Motley Fool recommends Walt Disney. The Motley Fool owns shares of Bank of America, Citigroup Inc , and Walt Disney. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.