Why Bank of America Is Defying the Dow's Drop

The Dow is down as the market frets over the debt ceiling and this morning's mixed economic releases. As of 1:15 p.m. EST, the Dow Jones Industrial Average is down 31 points, or 0.23%, to 13,504. The S&P 500 is down a fraction of a point to 1,472.

There were three economic releases this morning.

Report | Period | Actual | Previous |

|---|---|---|---|

Consumer Price Index | December | 0% | (0.3%) |

Core CPI | December | 0.1% | 0.1% |

Industrial Production | December | 0.3% | 1% |

NAHB Housing Market Index | December | 47 | 47 |

Source: MarketWatch U.S. Economic Calendar.

The first report was from the Department of Labor, which reported that the consumer price index, a measure of inflation, was flat in December compared with November. That was in line with analyst expectations. Year over year, the CPI was up 1.7%. Core CPI, a measure of inflation excluding food and energy, rose 0.1% in December. That's in line with analyst expectations and the same growth rate as in November. Year over year, core CPI is up 1.9%. That's basically in line with the Federal Reserve's target of 2% inflation.

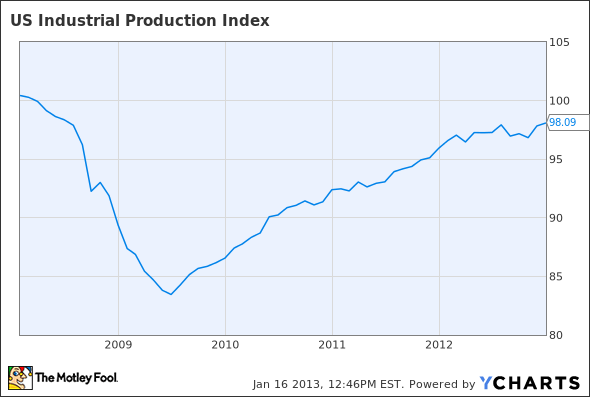

The second report was from the Federal Reserve, which reported that industrial production increased 0.3% in December -- a slower rate than November's 1% growth. Analysts had expected growth of 0.2%. Industrial production is now at its highest level since 2008.

US Industrial Production Index data by YCharts.

The third report was from the National Association of Home Builders, which reported that its Housing Market Index remained at 47. Analysts had expected the index to rise slightly to 48. The housing market strengthened in 2012, and hopefully it will continue to strengthen in 2013.

NAHB/Wells Fargo National HMI data by YCharts.

With that mishmash of news, the markets are focusing on the debt ceiling. The Treasury department hit the debt ceiling two weeks ago and expects to run out of cash around Feb. 15 unless the debt ceiling is raised. Republicans are considering using the debt ceiling as part of their negotiations over spending cuts. Fool analyst Morgan Housel took an in-depth look at the situation and speculates that "Feb. 15 could be the most important day in market history."

With not much positive news and congress jawboning over the debt ceiling, it's not a surprise that the Dow is down.

Today's Dow leader

Today's Dow leader is Bank of America , up 1.2%. The bank is up on news that it will ramp up mortgage lending again after greatly slowing its home lending business in 2010. Bank of America has missed out on a surge in the mortgage business as the Fed's efforts to lower mortgage rates led to a large growth in consumer refinancing. Bank of America had a banner year in 2012, with the stock gaining 107.3% as the bank settled with 49 states over the robo-signing fiasco, estimated its future liabilities to Fannie Mae and Freddie Mac, divested noncore operations, and significantly improved its financial situation. More recently, the stock has been rising as the U.S. housing market continues to improve. If more good news continues to roll out for the bank and the economy, perhaps Bank of America could again be a top stock in 2013.

To learn more about the most talked-about bank out there, check out our in-depth company report on Bank of America. The report details Bank of America's prospects, including three reasons to buy and three reasons to sell. Just click here to get access.

The article Why Bank of America Is Defying the Dow's Drop originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He owns shares of Bank of America. The Motley Fool owns shares of Bank of America. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.