Is Broadcom Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Broadcom's recent results tell us about its potential for future gains.

What the numbers tell you

The graphs you're about to see tell Broadcom's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always reported at a steady rate, we'll also look at how much Broadcom's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Broadcom's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

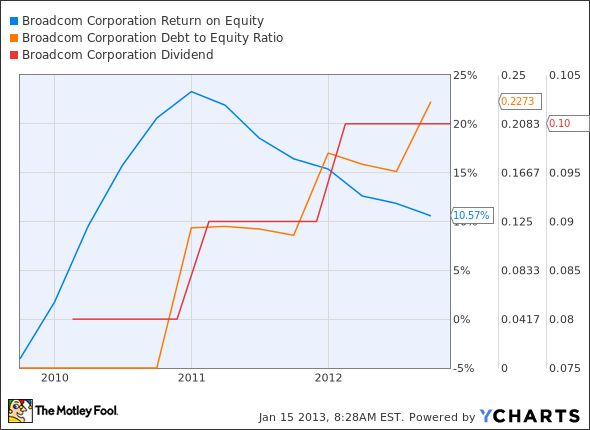

Is Broadcom managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Broadcom's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Broadcom's key statistics:

BRCM Total Return Price data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 81.2% | Pass |

Improving profit margin | 53.3% | Pass |

Free cash flow growth > Net income growth | 119% vs. 571.4% | Fail |

Improving EPS | 537.9% | Pass |

Stock growth (+ 15%) < EPS growth | 16.4% vs. 537.9% | Pass |

Source: YCharts. *Period begins at end of Q3 2009.

BRCM Return on Equity data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 360.3% | Pass |

Declining debt to equity | 90.1% | Fail |

Dividend growth > 25% | 11.1% | Fail |

Free cash flow payout ratio < 50% | 13.4% | Pass |

Source: YCharts. *Period begins at end of Q3 2009.

How we got here and where we're going

Broadcom's looking strong on the bottom line with our three-year timeframe -- so strong, in fact, that it's lost out on one passing grade by letting its free cash flow fall behind. Six out of nine possible passing grades is a respectable score, however, and as our tracking period gets closer to the present, Broadcom's free cash flow starts to pull ahead again. That could present problems, since falling net income will hamper EPS and return on equity going forward. What will Broadcom need to do to maintain its momentum?

Thus far, Broadcom's done a good job at holding onto a top-five position in the smartphone chip race. It's probably not going to come close to Qualcomm , which controls nearly half of the smartphone processor market, but Broadcom has become a low-cost alternative to Qualcomm's high-end Snapdragon chips. As cheaper Samsung-built Android phones catch on in India, China, and other lower-income nations, this could give Broadcom the push necessary to turn around what's been a stagnating bottom line since the end of 2010. Broadcom's also strongly positioned in touchscreen controllers and Wi-Fi combo chips, which are less under fire from its larger rivals.

Broadcom's latest earnings provide a window into its progress, as it was the company's first $2 billion revenue quarter and first $1 billion revenue quarter for the mobile/wireless segment. This was offset by increased research and development costs, which investors may need to accept going forward if they want Broadcom to hold the line in a fiercely competitive mobile battle. We haven't even seen a serious Intel beachhead yet, and that company can bring more cash to bear on R&D (or other efforts, should it wish to) than the combined forces of every major mobile chip designer and manufacturer on the market today. Intel is a serious threat on the horizon, although it may be more immediately threatening to Qualcomm's Snapdragons than Broadcom's chips.

Our Foolish tech analysts found Broadcom and Qualcomm both promoting new indoor-positioning chips at this year's Consumer Electronics Show. It seems that everywhere Broadcom wants to go, Qualcomm is going (or has already been there) as well. Such chips would be ideal tools for General Electric's industrial Internet, which promises to make all kinds of objects and processes more connected. Broadcom already has a leg up in that field, as it's put together a simple Wi-Fi chip that seems like the sort of thing indoor positioning chips might evolve from. Factory operations, hospital machinery, and warehouse systems could all benefit from a precise location database -- and all three of these are likely to be on the table in GE's labs. That's just a small slice of potential, and I'm sure you can envision other ways that connectivity can help make today's dispersed systems smarter.

Broadcom has a number of opportunities, but it remains locked in fiercely competitive battles with well-heeled opponents. The company holds some important ground in Wi-Fi and touchscreens, which will sustain it in a more mobile world. Will that be enough for growth? It may not take long to find out.

Putting the pieces together

Today, Broadcom has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

What's inside Supernova?

Innovators in technology have been a driving investing theme for Motley Fool co-founder David Gardner, helping lead his stock picks to gains of more than 122% in our Stock Advisor service since it launched in 2002. David has managed to trounce the market by always being on the lookout for revolutionary stocks and recommending them before Wall Street catches on to their disruptive potential. If you're interested in how David discovers his winners, click here to get instant access to a personal tour of David's Supernova service.

The article Is Broadcom Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes owns shares of Intel. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool recommends Intel. The Motley Fool owns shares of General Electric, Intel, and Qualcomm. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.