Can This Boring Dividend Stock Produce Exciting Returns?

Stodgy stocks in unglamorous industries are often rock-solid cash cows. Nobody cares if you're not setting the world on fire -- as long as you can ratchet up dividend payments on a regular basis.

Garbage disposal specialist Waste Management is a poster boy for this strategy. I dare you to come up with a less attractive business than disposing of the refuse of our modern world. Somebody has to do it, though, and Waste Management has found a way to squeeze prodigious amounts of cash out of the dirty work -- and it's returning oodles of it to shareholders. You could set a clock by the company's dividend boosts.

WM Dividend data by YCharts.

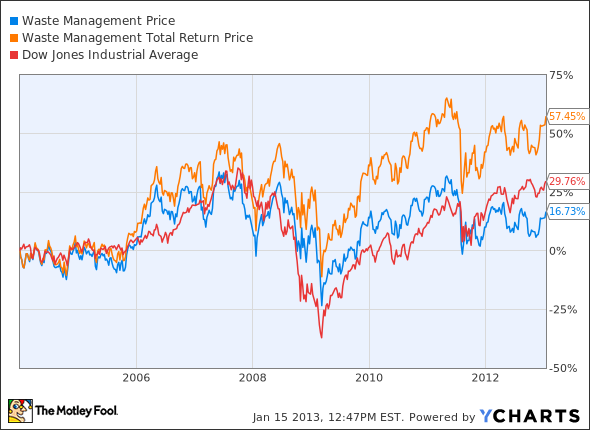

The payouts make a huge difference for investors. In terms of plain share prices, Waste Management has trailed the Dow Jones over the long term. But assuming you took dividends along the way to reinvest them in more shares, the picture changes dramatically:

The 4.1% dividend yield and impeccable history of increases make Waste Management a solid income stock. The yield stands back to back with fellow income favorites in far more ritzy markets. Microchip giant Intel and oil transportation specialist Magellan Midstream Partners both match Waste Management's generous yield exactly. Ubiquitous fast-food guru McDonald's can only muster a 3.4% yield. Garbage handling may not be sexy, but it's an investable enterprise totally on par with semiconductors, black gold, and everyday consumer staples.

Waste Management has been a longtime favorite of dividend seekers everywhere, but the share price performance over the last few years has left many investors wanting. If you're wondering whether this dividend dynamo is a buy today, you should read our premium analyst report on the company. Just click here now for access.

The article Can This Boring Dividend Stock Produce Exciting Returns? originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Intel, but he holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of McDonald's, Waste Management, and Intel. Motley Fool newsletter services have recommended buying shares of McDonald's, Waste Management, Intel, and Magellan Midstream Partners. The Motley Fool has a disclosure policy.

We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.