Is Macau's Growth a Sign of Trouble?

Macau returned to strong growth in December and this has helped gaming stocks post great gains in recent weeks. Throughout most of 2012 the growth of gaming slowed, but December showed a huge turnaround with $3.5 billion in revenue, up 20% from a year earlier, bringing 2012's growth to 13.5%.

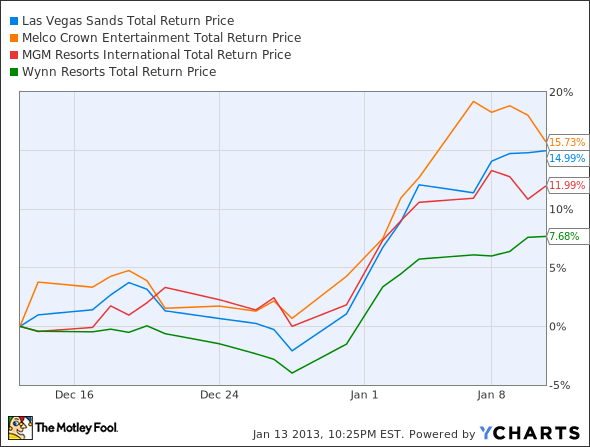

Companies with a lot of exposure to Macau have jumped over the past month as investors anticipated the news. Melco Crown , Las Vegas Sands , and MGM Resorts have all gained double-digit percentages in just a month, and Wynn Resorts doesn't trail far behind.

LVS Total Return Price data by YCharts.

These gains are all on the back of Macau's growth and particularly strong numbers in December, but there are reasons to think the strong December isn't such a good thing long-term. So, is this a good sign or a sign of trouble for Macau? I'll give both sides of the story.

The growth engine that doesn't stop

If you're a Macau bull, you can see the growth as a sign that the constant growth of the Chinese economy and growing infrastructure funneling gamblers to Macau is paying off. China grew at 7.4% in the third quarter, lower than recent years but still robust growth in such a large nation.

As the country grows, so does the middle class, which adds to the number of people willing to gamble in Macau. The evidence can be seen by strength in mass-market play while VIP play has struggled throughout much of the year.

The bullish case is very simple, and it's easy to take growth numbers and translate them into strong fundamentals for Macau. But there's another side of the story that investors should consider.

Trouble on the horizon

One of the reasons December may have been stronger than recent months is that wealthy Chinese are likely getting money out of Macau before the new government is able to crack down on corruption and money laundering. I brought this up in November as a reason I was reducing my exposure to Macau, and the bearish view is that this is the first sign of trouble.

One of the dirty secrets of Macau is that junkets and casinos are used transfer money from China in excess of the $50,000 limit a citizen is allowed. VIPs go to a junket like Asia Entertainment & Resources, which provides a loan in China, and the player can gamble with the money. When the player cashes out, they take Macanese patacas and can transfer that into Hong Kong dollars and get millions of dollars out of China fairly easily.

This money-laundering scheme is one of the reasons around 70% of Macau's gaming comes from VIPs and by extension, junkets.

There's evidence that Chinese are fleeing the country, so it's not out of the question. The New York Timesreported that the Organization for Economic Cooperation and Development reported a 45% increase of emigrants from China from 2000 to 2010. In 2011, 87,000 permanent residents from China came to the U.S., up from 70,000 a year earlier.

How do we know the real story?

So how do we know if this is great news for Macau or a sign of trouble ahead?

The easy answer is to watch gaming growth in 2013 and keep an eye on the mix. If VIP gaming slows from December's numbers, it's a sign that Chinese citizens have gotten the money they need to out of China.

Concerns about the stability of Macau's growth have been coming up for years, and so far there hasn't been anything to slow down the region significantly. I'll keep an eye on the trends over the next few months and we'll see if growth slows down or VIPs hit the tables less.

For now, Macau looks to be growing with no end in sight. The growth of the mass market was particularly encouraging in 2012, because through the third quarter, VIP baccarat play was falling off slightly. This mass market will help Cotai grow and make Las Vegas Sands and Melco Crown intriguing this year.

What's inside Supernova?

Make sure you start 2013 with a bang and get the inside scoop on what Motley Fool superinvestor David Gardner will be buying this year. He's crushed the market in his Stock Advisor and Rule Breakers portfolios for years, and now I invite you to a personal tour of his flagship stock picking service: Supernova. Just click here now for instant access.

The article Is Macau's Growth a Sign of Trouble? originally appeared on Fool.com.

Travis Hoium manages an account that owns shares of Wynn Resorts, Limited. You can follow Travis on Twitter at @FlushDrawFool, check out his personal stock holdings or follow his CAPS picks at TMFFlushDraw. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.