This Week in Solar

This has been a great year for solar stocks so far. Most have gained by double-digit percentage points as investors jump into the industry. But the gains weren't because of fundamentally strong numbers; they were more speculative in nature, so I'm taking a cautious approach to the recent gains.

With all that's going on in solar, investors need to stay up to date with what's going on. Here's the latest news -- this week in solar.

Going subsidy-free

First Solar is making a big move to go subsidy-free with its purchase of Solar Chile. The company has 1.5 gigawatts of early-stage development in northern Chile, one of the best areas for solar in the world. The company's first project is a 30.2-megawatt project called La Tirana, which has received environmental permitting and will begin construction in March.

There are two reasons First Solar will be able to build projects subsidy free in Chile. First, the area's high insolation will generate more power per panel than most locations. Second, Chile is a growing market with a relatively high cost of energy. Prices on the spot market were over $0.25 per kilowatt hour last year, and with construction costs of around $2.50 per watt, First Solar should be able to make a profit without subsidies.

First Solar is in a transition to more of a project builder than module maker, and this is just the latest sign. To keep you up to date whenever news breaks, we've created a brand-new report that details both the good and the bad of First Solar's strategic moves. To get started, just click here now.

Hope for better days

GT Advanced Technologies announced this week that it will reorganize its operations to a functional structure to capitalize on growth opportunities going forward. The change itself probably won't make a difference in GT's results, but I do have two takeaways from the announcement.

First, reorganizations are often done in times of crisis, when management doesn't know what else to do. I've been in organizations that have gone from functional to business unit to functional structures over a matter of years, and little changes.

The one area that might change -- moving to my second point -- is GT's R&D function. Having R&D under one "roof" may be advantageous, because the company can then share technologies and ideas with a growing number of business lines.

Recapping the first two weeks of 2013

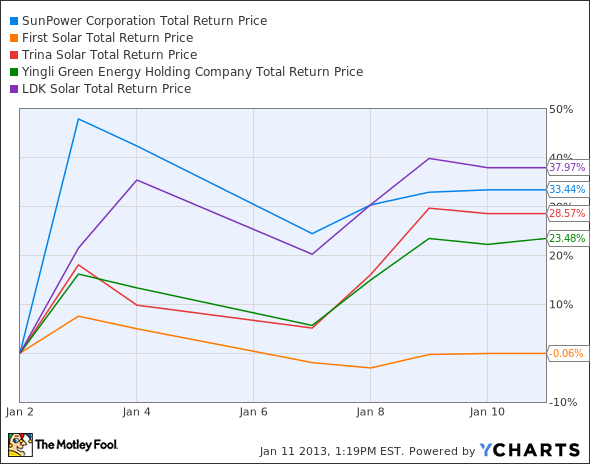

The first two weeks of 2013 have been incredibly positive for solar investors. Take a look t how far SunPower , Trina Solar , LDK Solar , and Yingli Green Energy have come in a short period of time.

SPWR Total Return Price data by YCharts.

But investors shouldn't forget the reasons that solar stocks are up. China added more subsidies for solar companies and plans to set a record for installations in one country next year at 10 GW. That's positive for everyone, particularly Chinese manufacturers. But let's not forget that at the same time, Chinese regulators said they will allow companies to fail, reduce subsidies, and encourage mergers in the industry. This means some companies will leave equity holders with nothing when they go out of business.

This isn't a time to buy low-quality solar stocks such as LDK Solar, Suntech Power , or Yingli Green Energy, which all have unsustainable balance sheets. Stick with quality to ensure that you're not left holding the bag when China decides who the winners and losers will be. That's why I own SunPower and would consider First Solar as well. There's no immediate risk of insolvency, and that's something you can't say for most Chinese solar companies.

Solar news and notes

Here are some of the noteworthy items that may have slipped by the headlines this week.

The Solar Energy Industries Association this week sent out a statement applauding an expansion of New York state's NY-Sun Initiative program. Gov. Andrew Cuomo funded the initiative with $150 million per year for 10 years and announced plans to create a $1 billion green bank.

JA Solar announced that it started mass production of 5-inch monocrystalline modules with a maximum power output of 210 watts.

Yingli Green Energy said it shipped a record number of modules in Q2 2012 and reached another record of 2.2 GW for the full year. CEO Liansheng Miao said this milestone makes the company the world's largest solar manufacturer. I will note that two companies to previously hold that title are Q.Cells and Suntech Power. The former is bankrupt, and the latter is well on its way to bankruptcy. Be careful what you wish for.

LDK Solar regained compliance with New York Stock Exchange rules by trading above $1 for 30 days. Thhe company now avoids a delisting, although it still faces a lot of challenges going forward.

That's all for this week in solar. Check back next week, when I'll catch you up on everything that's happening around this exciting industry.

First Solar is in a transition to more of a project builder than module maker, and this is just the latest sign. To keep you up to date whenever news breaks, we've created a brand-new report that details both the good and the bad of First Solar's strategic moves. To get started, just click here now.

The article This Week in Solar originally appeared on Fool.com.

Travis Hoium owns shares of SunPower and manages an account that owns shares of SunPower. He is also long Jan 2015 $7 calls on SunPower and long Jan 2015 $5 calls on SunPower. You can follow Travis on Twitter at @FlushDrawFool, check out his personal stock holdings, or follow his CAPS picks at TMFFlushDraw. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.