Wells Fargo Earnings: The Stagecoach Rolls On

Stocks opened in the red this morning, with the Dow Jones Industrial Average down 0.19% and the broader S&P 500 down 0.20% as of 10:10 a.m. EST.

Wells Fargo beats expectations

The largest mortgage-lender in the U.S., Wells Fargo , reported fourth-quarter results this morning. Earnings per share came in at $0.89, which beat analyst expectations by $0.02. Revenue also came in ahead of expectations at $21.95 billion versus $21.29 billion. Nevertheless, the market is unimpressed, and the stock is underperforming the broad market this morning.

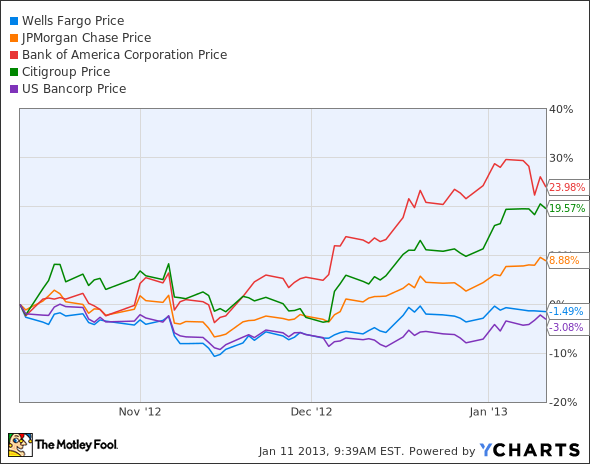

In fact, Wells Fargo's stock has lagged those of its universal-banking competitors -- Bank of America , JPMorgan Chase and Citigroup -- during the rally in bank shares of the past three months (see graph below). However, this partially reflects the other banks' rebound from a horrific performance in 2011. Note that US Bancorp -- a pure-play commercial bank and arguably Wells' best comparison -- has also lagged the universal banks.

Despite this, there is a stark distinction between the two groups: Wells and US Bancorp trade at a premium to their book values, while the rest trade at a discount (JPMorgan is the closest to closing that discount with a price-to-book-value ratio of 0.92).

Wells Fargo is well-positioned to profit from the refinancing boom now underway, and last quarter's results bear that out. On a longer-term basis, it stands to benefit from the recovery in the housing market. More focused and better-managed, Wells Fargo trades at a premium to its largest competitors and, importantly, is less subject to swings in its valuation. For investors seeking to capture above-average returns through buying misvalued stocks, there are better candidates than Wells. However, for long-term investors with more modest goals, it should produce acceptable returns from current prices over the full course of a credit cycle (or more than one, ideally!).

To learn more about the most talked-about bank out there, check out our in-depth company report on Bank of America. The report details Bank of America's prospects, including three reasons to buy and three reasons to sell. Just click here to get access.

The article Wells Fargo Earnings: The Stagecoach Rolls On originally appeared on Fool.com.

Alex Dumortier, CFA has no position in any stocks mentioned; you can follow him @longrunreturns. The Motley Fool recommends Wells Fargo & Company. The Motley Fool owns shares of Bank of America and Wells Fargo & Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.