Is Hasbro Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Hasbro's (NAS: HAS) recent results tell us about its potential for future gains.

What the numbers tell you

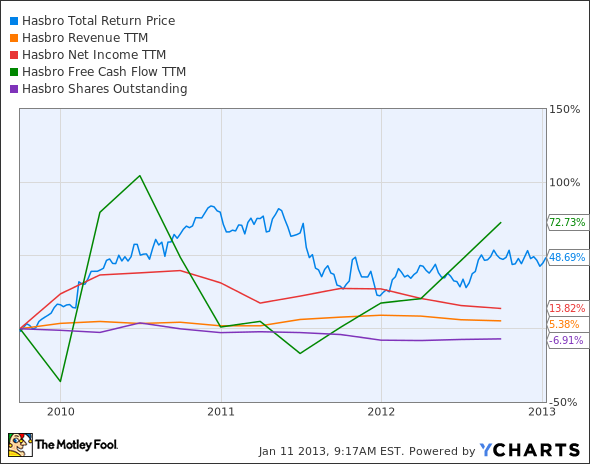

The graphs you're about to see tell Hasbro's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always be reported at a steady rate, we'll also look at how much Hasbro's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Hasbro's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

Is Hasbro managing its resources well? A company's return on equity should be improving and its debt-to-equity ratio declining if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Hasbro's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Hasbro's key statistics:

HAS Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 5.4% | Fail |

Improving profit margin | 4.3% | Pass |

Free cash flow growth > Net income growth | 72.7% vs. 13.8% | Pass |

Improving EPS | 28% | Pass |

Stock growth (+ 15%) < EPS growth | 48.7% vs. 28% | Fail |

Source: YCharts. * Period begins at end of Q3 2009.

HAS Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 12% | Pass |

Declining debt to equity | 38.8% | Fail |

Dividend growth > 25% | 80% | Pass |

Free cash flow payout ratio < 50% | 39.2% | Pass |

Source: YCharts. * Period begins at end of Q3 2009.

How we got here and where we're going

Hasbro's slow growth on top and bottom lines have hindered it somewhat, but the toy maker still comes away with six out of nine possible passing grades. The only real area of concern here might be Hasbro's stock outpacing its earnings-per-share improvements. But if we were to compare the stock to its free cash flow growth, there would be no cause for concern. We can live with some tepid revenue gains as long as Hasbro can squeeze more profitability out of its operations without sacrificing future growth. But is that what Hasbro is doing, or has it gone too far in pursuit of profit? Let's dig deeper.

Despite its apparently reasonable progress, Hasbro had failed to impress the Street for four out of five quarters between the end of 2010 and the start of 2012. Although Hasbro did beat estimates in its second quarter, those estimates were already lower than the prior year. A tie to the superbomb Battleship film didn't do much to boost the company this year in the manner of the three Transformers movies. Perhaps if the battleships had secretly been intergalactic robots...

Hasbro's also fallen behind sector leader Mattel (NAS: MAT) in recent years, particularly since mid-2011, when their paths diverged and Mattel's stock continued to grow as Hasbro flatlined. Mattel's net income has kept pace almost perfectly with its stock price, but Hasbro's has diverged. The one bright spot in this comparison is Hasbro's superior free cash flow growth -- Mattel has managed only an 8% increase in that metric over the past three years.

What Hasbro has going for it, beyond a superior dividend yield, is perhaps the best entertainment licensing arms in the business. Hasbro's got a long-standing relationship with Disney (NYS: DIS) , which is as near a license to print money as you can find in the toy world. Every time a Disney character becomes passe with the kids, the House of Mouse has managed to invent a new one. With Pixar, Marvel, and now Lucasfilm in the Disney stable, Hasbro has the inside track to produce toy versions of many of the world's most popular fictional characters.

Hasbro also has licensing deals with Electronic Arts (NAS: EA) and Zynga (NAS: ZNGA) to extend its brand into the digital realm and to extend Zynga's brand (such as it is) into the real world. The EA deal is more interesting, as it keeps Hasbro relevant in a world that's rapidly shifting to predominantly electronic forms of entertainment. For comparison, all you have to do is look at LeapFrog (NYS: LF) , which makes a hit tablet for children that was among one of the hottest toys for the holiday season , right next to Hasbro's own Furby.

Hasbro's in an interesting position today. It's established a mastery of many physical properties, but it still faces threats from the virtual entertainment offered by LeapFrog, video game developers, and other tablet makers. With the current crop of children growing up surrounded by gizmos, is there still room for Hasbro to grow? The answer has been yes so far, but investors have to be concerned about the possibility of stagnation and obsolescence.

Putting the pieces together

Today, Hasbro has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Hasbro was one of David Gardner's earliest recommendations for The Motley Fool's flagship Stock Advisor service, and investors have earned a three-bagger since his first call in 2003, which is over 108% greater than the S&P 500's gains in the same time frame. Now, David is taking the methodology that's helped Stock Advisor shareholders trounce the indexes and enhancing it with fresh insight in the Fool's new Supernova service. For a limited time, you can get an exclusive free look at Supernova to see for yourself the exciting new service that investors everywhere are talking about. Click here to take your free tour today!

The article Is Hasbro Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool recommends Hasbro, LeapFrog Enterprises, Mattel, and Walt Disney. The Motley Fool owns shares of Hasbro, Mattel, and Walt Disney. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.