2 Ways to Fail at a Holiday Turnaround

The holiday season is a make-or-break moment for many retailers. And that's especially true for those that are struggling. If you've been turning in weak results for most of the year, the shopping-heavy fourth quarter can make up for a lot of lost time.

Unfortunately for GameStop and Tiffany , the holiday season redemptions that they were hoping for flopped. But the strategies came up short for different reasons.

Let's dive right into the retail carnage to see if there's any gas left in their turnaround stories.

Too few shoppers

GameStop has a customer problem. As in, it doesn't have enough customers. The game retailer just couldn't pack shoppers into its stores over the holidays. Despite starting from a bigger base of locations this year, it reported a 4.6% drop in holiday sales thanks to "lower store traffic."

What's worse is that those results were inflated by the successful launch of a new gaming console, the Wii U, which should have boosted store traffic. GameStop sold more than 300,000 units of Nintendo's device, but that still wasn't enough to manage a positive contribution to revenue. Instead, new hardware sales slid by 2.7%.

Thanks to those poor holiday results, the company had to "narrow" its forecast for fourth-quarter sales to between -7% and -4%. GameStop had hoped to eke out a positive quarter but now looks set to book its eighth straight quarterly sales decline.

On the bright side, GameStop's digital receipts were way up, by 40%, and e-commerce sales jumped by 20%. That has been the trend for a few struggling retailers. Sears grew online sales by 20% this holiday season despite turning in negative overall sales growth. And Best Buy managed an impressive 10% jump in e-commerce revenue, to $1.1 billion, while trumpeting "flat" total sales. Just keep in mind that these are only revenue figures being reported. We'll have to wait until these retailers share their full-quarter results to see how much profit online selling ends up contributing to the bottom line.

Too-high prices

But jewelry is one product category that tends to be both profitable and popular during the holidays. And Tiffany was looking to that all-important season to help it recover from a disastrous third quarter that saw earnings fall by 30%. Yet holiday sales disappointed. The company managed to report sales growth, but at a much slower pace than expected. Global sales were up just 4%. Domestically, sales only managed to rise by 3%, and they were down 2% at the company's flagship store in New York.

Thanks to that lump of coal, earnings are now expected to come in at the low end of the $3.20-$3.40 range the company provided in late November. And that forecast itself was down from the $3.55-$3.77 range Tiffany expected before the third quarter.

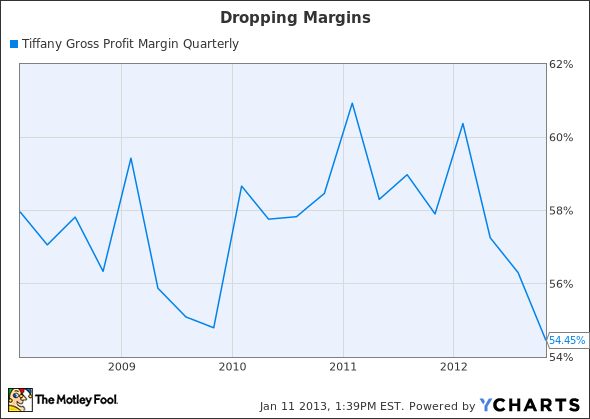

Tiffany is struggling to protect its strong profit margins, which have fallen to a five-year low, driven by rising input costs. Until just recently, the company's stellar brand appeared to be a bulletproof source of pricing power against the competition. Tiffany's 60% gross profit stacked up well against Blue Nile and its 20% figure.

Comparisons like that are why CEO Michael Kowalski could boast, as he did in the second quarter of 2011, that Tiffany was "able to absorb precious metal and gemstone cost increases while improving our gross and operating margins."

But that positive trend just hasn't held up. Precious metal and gemstone costs kept rising, but gross margins didn't.

TIF Gross Profit Margin Quarterly data by YCharts.

Still, Tiffany's rough holiday season hasn't knocked the company too far off track. Plans are still in the works for store expansions, and Tiffany expects earnings growth in the neighborhood of 6% to 9% in 2013.

Foolish bottom line

While the holidays didn't bring better fortunes for either retailer, they did point the way toward eventual recovery.

For GameStop, digital content and e-commerce are the future of the industry, and so the company's early success there is encouraging. And Tiffany's results should improve as soon as input price inflation moderates. But until then, both retailers are at the mercy of some tough industry trends. And, as their holiday results show, there isn't much that they can do about it.

Make sure you start 2013 with a bang and get the inside scoop on what Motley Fool superinvestor David Gardner will be buying this year. He's crushed the market in his Stock Advisor and Rule Breakers portfolios for years, and now I invite you to a personal tour of his flagship stock picking service: Supernova. Just click here now for instant access.

The article 2 Ways to Fail at a Holiday Turnaround originally appeared on Fool.com.

Demitrios Kalogeropoulos has no position in any stocks mentioned. The Motley Fool recommends Blue Nile. The Motley Fool owns shares of GameStop and Tiffany & Co.. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.