Will Intel See Another Symbolic Loss in 2013?

With how the application processor value chain is evolving right now, Intel , faces incredible uncertainty heading into the mobile revolution. Once upon a time, it had a stranglehold supplying chips to computing devices, but that's loosening now that consumers increasingly connect via smartphones and tablets with no Intel inside.

Three in one

Whereas Intel's focus has always been vertical integration of architecture, design, and manufacturing, the mobile value chain is segmenting those roles, and the inherent competition within each layer is undermining the pricing power that Intel has enjoyed for decades.

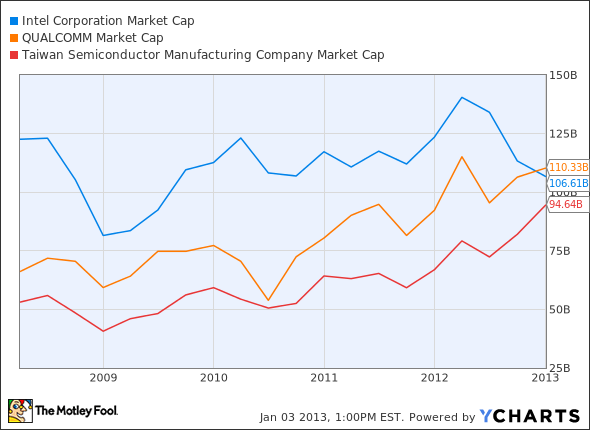

At the end of last year, mobile chip giant Qualcomm enjoyed a symbolic victory over Intel as its market cap overtook Intel's for the first time ever, earning it the title of the largest semiconductor company in the world by market cap. (Intel is still top dog in terms of sheer revenue.) As the market leader in both mobile applications processors and baseband modems, the event was a milestone that aptly embodies the broader shift to mobile platforms.

Will Intel see another symbolic loss in valuation in 2013? Chip manufacturer Taiwan Semiconductor isn't far behind now.

INTC Market Cap data by YCharts.

At the rate that the two are going, it's very conceivable that Taiwan Semiconductor's valuation could top Intel's by year's end, as the former is the dominant chip manufacturer. If you look at each company's recent growth figures for both top and bottom lines, it's obvious why each player's market cap trajectories are heading up or down.

Company | Sales Growth (MRQ) | Sales Growth (TTM) | EPS Growth (MRQ) | EPS Growth (TTM) |

|---|---|---|---|---|

Intel | (5.5%) | 4.2% | (11.2%) | (1.1%) |

Qualcomm | 18.3% | 27.8% | 15.6% | 13.1% |

Taiwan Semiconductor | 32.8% | 10.9% | 62.2% | 8.9% |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter.

Intel's figures have struggled in the face of stagnant PC sales, of which it remains heavily reliant on, for better or for worse. Lately, that's been worse as consumer spending shifts.

Who needs the PC

Growth in the data center driven by the cloud can only go so far, and can't even come close to making up losses in the PC division, especially if they get worse. Here's how each segment pitched in to sales last quarter.

Segment | Net Revenue (MRQ) | Percentage of Total Revenue (MRQ) | Growth (YOY) |

|---|---|---|---|

PC client group | $8.6 billion | 64.2% | (8.3%) |

Data center group | $2.7 billion | 19.7% | 5.7% |

Source: Intel 10-Q. MRQ = most recent quarter.

Looking at operating income for each segment paints an even clearer picture: Intel's business is still all about the PC.

Segment | Operating Income (MRQ) | Percentage of Total Operating Income (MRQ) | Growth (YOY) |

|---|---|---|---|

PC client group | $3.3 billion | 86.8% | (16.8%) |

Data center group | $1.2 billion | 31.5% | (0.7%) |

Source: Intel 10-Q. MRQ = most recent quarter. Percentages sum to greater than 100% due to operating losses in other segments not shown.

It's no surprise that Intel is considering expanding its small foundry business, although it has said specifically that it's not looking to compete directly with Taiwan Semiconductor. But putting that excess capacity to use in the face of declining PC chip shipments is better than idling those expensive factories.

The weakest link

Qualcomm easily represents the leader in competing chip design, Taiwan Semiconductor is top dog in manufacturing, and ARM Holdings provides the architecture piece of the puzzle. ARM's market cap remains well below Intel's at $18 billion, so it's highly unlikely that ARM could overtake Intel in valuation any time soon. Besides, ARM's own role in the value chain is less profitable than those in design and manufacture.

By the end of 2013, don't be surprised if Taiwan Semiconductor joins Qualcomm in looking down on Intel's market cap.

The article Will Intel See Another Symbolic Loss in 2013? originally appeared on Fool.com.

Fool contributor Evan Niu, CFA, owns shares of Qualcomm. The Motley Fool owns shares of Intel and Qualcomm. Motley Fool newsletter services recommend Intel. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.