The Best Way You Can Play the Fiscal Cliff Deal

With hours to spare, Congress avoided the fiscal cliff and averted an economic paralysis that could've hurtled the world back into a global recession. But despite the miss, there are still winners and losers out there that you need to know about. I've identified a key sector that's come out on top, as well as a rare double play for some of its most innovative companies.

Drumroll please

After the global recession of 2008, investors pulled out of international stocks, small caps, and everything under the sun with the word "growth" anywhere in its business plan. They ran to dividend stocks, only to have fears of the fiscal cliff's massive dividend tax hike back them out of yet another hole.

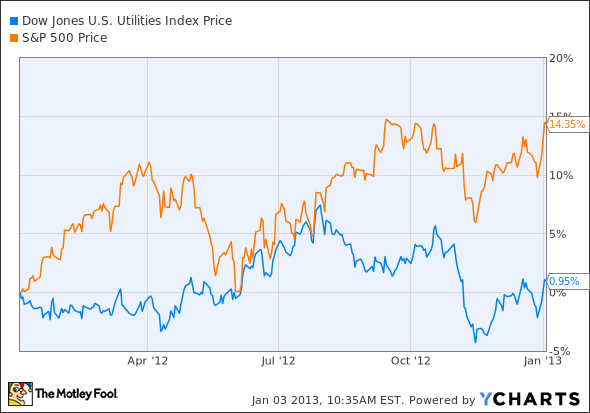

But the fears turned out to be unfounded, and income from dividends will bump up just 5% to 20%, and not at all if you make less than $400,000 a year (or $450,000 for joint filers). Utilities rely on dividends to return value to shareholders, and have underperformed the S&P 500 by more than 13% in 2012:

With dividend tax hikes under control, this sector could be on a fast track to recovery in 2013. The energy sector is changing fast, and picking the right utility could prove to bring in much more than inflation-proof returns.

Two-for-one deal

Bob Dylan said it best: "The answer, my friend, is blowing in the wind." Not only did Congress' deal reopen the door to dividend stocks, but it also extended a lucrative production tax credit for wind energy. For utilities with windy energy portfolios, top-line and bottom-line expectations are soaring.

The extension continues a 2.2 cents-per-KWH wind credit that first enabled the wind industry to gain traction years ago. With the new deal, any projects started in 2013 will receive the credit for up to 10 years of production. In 2012, a record 44% of new electricity capacity came from wind energy, and the American Wind Energy Association sees the extension as vital to reviving dashed hopes for wind's cost-effectiveness.

Companies to consider

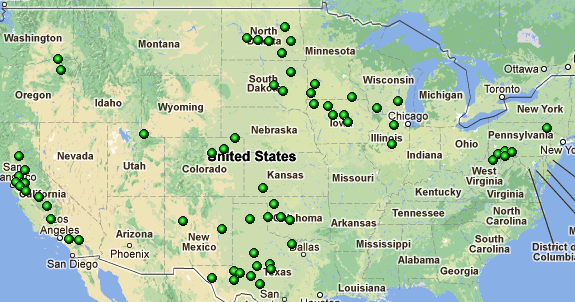

NextEra Energy is the main utility contender for "Best in Fiscal Cliff Show." It's the largest producer of renewable energy in the U.S., and has almost 90 wind farms across 17 states and Canada.

Source: NextEra Energy

The utility's wind farms produce almost 8,750 net MW of electricity, and account for more than half of NextEra's total generation. Its latest facility came online just two weeks ago in Ontario, and the company commissioned its 10,000th MW of wind power in December.

Duke Energy recently increased its commitment to wind energy, and could be well on its way to becoming a more important player in the realm of renewables. Its latest Q3 report puts wind generation at approximately 1,200 MW, with renewables making up 9% of Duke's total capacity.

Exelon is an interesting play. Despite operating 39 wind farms with nearly 1,300 MW of generation capacity, the utility has vehemently opposed any extension of the production tax credit. Its thumbs-down cost Exelon its membership in the American Wind Energy Association last September, but is seen as necessary to protect the cost-effectiveness of its nuclear fleet. With a commitment to clean energy, Exelon will have to reorient its current energy plans, but could ultimately come out on top.

As a final note, beware the coal- and oil-centric utilities of yesteryear. Congress has reaffirmed its commitment to ramping up investment in renewables, and cheap natural gas has created an economic argument to seal the deal. According to Carbon Monitoring for Action, Southern Company , American Electric Power Company , and AES top the list of U.S. utility carbon emitters. Dividend stocks might be back in vogue, but that doesn't mean there won't be losers.

With its diversified and increasingly clean energy portfolio, Exelon could be in the perfect position for 2013. Having the largest nuclear fleet in North America combined with an increased focus on renewable energy, along with its recent merger with Constellation, puts Exelon and its best-in-class dividend on a short list of top utilities. To determine if Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

The article The Best Way You Can Play the Fiscal Cliff Deal originally appeared on Fool.com.

Justin Loiseau has no positions in the stocks mentioned above, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo. The Motley Fool has no positions in the stocks mentioned above. Motley Fool newsletter services recommend Exelon and Southern Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.