Can Antares' Products Power Your Portfolio in 2013?

Antares Pharma excited shareholders in 2012 with shares surging 75%. But what is the outlook for the new year? Over the next few days, we will take a look at several key factors to see if Antares can continue to make the grade for investors. Let's start out by examining the company's current product lineup.

Strengths

The stellar stock performance for Antares in 2012 came on the shoulders of the company's products, which include self-injection devices and topical gels. One major strength is that these products are in high demand. Sales have increased tremendously over the last four years.

Source: Company 10Q reports.

As the chart above shows, Antares' product revenue is composed of three categories: product sales, licensing, and royalties. The company also generates revenue through development with partners. Product sales have grown nicely.

Another key strength for Antares lies in its relationships with larger third parties that license or partner with the company. Teva Pharmaceuticals is one of Antares' primary customers that licenses its needle-free injection devices for administering human growth hormones. Watson Pharmaceuticals licenses the company's gel for treating overactive bladder, and markets the product in the U.S. and Canada.

Weaknesses

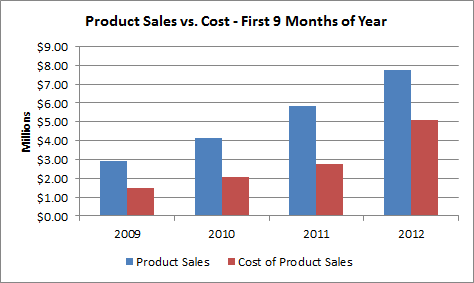

While Antares' products show strong sales growth and the company continues to benefit from arrangements with solid partners, one glaring weakness emerged over the past year. The costs of its product sales has risen faster than the actual product sales.

Source: Company 10Q reports.

From 2009 through 2011, cost of product sales hovered around 50% of product sales. However, that figure jumped to 65% in 2012. What changed? The increase related to Antares' supplying oxybutynin gel to Watson Pharmaceuticals. This weakness should only be temporary, though, since Watson takes over manufacturing the gel in 2013.

Opportunities

Investors usually like companies that have the razors-and-blades business model where more money can be made over the long run from selling blades than selling the razors. Antares has the opportunity to capitalize even more than it has in the past on this business model.

Source: Company 10K reports.

As Antares increases the volume of self-injection devices that it sells directly rather than via licensing arrangements, the revenue generated from disposable components should grow even stronger. Those are the kind of recurring revenues that any business likes to have.

Another significant opportunity is in increasing sales of transdermal products. Transdermal item revenue in the first nine months of 2012 jumped nearly eight times that of the same period in 2011, largely due to Antares' deal with Watson. While this balloon will surely deflate a good bit in 2013, continued growth in the transdermal market remains a great opportunity.

Perhaps the best overall opportunity for Antares, though, stems from trends toward patient self-administration of drugs. These trends are a result of cost-containment efforts and personal preferences of patients. With its self-injection and transdermal products, Antares' products are well-positioned to benefit from these trends.

Threats

One key threat that Antares faces with its current products stems from competition. Several rivals make self-injection devices, including Ypsomed AG and SHL Group AB. Major competitors in the transdermal market include Abbott Labs and Eli Lilly . Pfizer and GlaxoSmithKline rank as leading rivals to Antares' oxybutynin gel.

Another significant threat is Antares' heavy dependence on two primary customers. In 2011, the company obtained 50% of total revenue from Teva and 35% from Ferring. While the deal with Watson helped to reduce those percentages in 2012, any issues related to these large customers could hurt Antares' product sales.

Making the grade

Strong growth, solid partnerships, and good opportunities make Antares' current products attractive. However, the company faces capable competitors in all of its markets and is still very reliant on large customers. My grade, therefore, for Antares' current product lineup is a "B+."

Current products, however, make up only one component of grading a company. Stay tuned over the coming days as we delve into Antares' pipeline, financials and management team to determine an overall grade for this small-but-growing firm.

What's inside Supernova?

If you're an investor looking for big long-term winners, Motley Fool co-founder David Gardner's picks have frequently trounced the market. How? Because he's always on the lookout for revolutionary stocks and recommends them before Wall Street catches on to their disruptive potential. If you're interested in how David discovers his winners, click here to get instant access to a personal tour behind David's Supernova service.

The article Can Antares' Products Power Your Portfolio in 2013? originally appeared on Fool.com.

Fool contributor Keith Speights has no positions in the stocks mentioned above. The Motley Fool has no positions in the stocks mentioned above. Motley Fool newsletter services recommend GlaxoSmithKline. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.