As Auto Sales Rev Up, So Could Auto Shares

After posting their best one-day performances in more than a year yesterday, it's no surprise that stocks are taking a breather this morning. The Dow Jones Industrial Average and the broader S&P 500 are down 0.2% and 0.1%, respectively, as of 10:15 a.m. EST.

Auto sales motor ahead

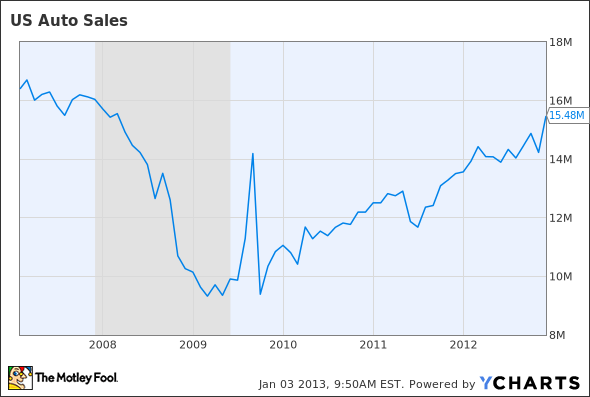

Auto manufacturers will release December and full-year sales figures today, with new-vehicle sales set to reach 14.4 million units in 2012. Auto sector research firm R.L. Polk is forecasting this year's sales could reach 15.3 million for economy-thumping 7% year-on-year growth. That would put the sector on track to achieve sales of 16 million units the following year, which would be the first time it hit that milestone since 2007 (see the graph below; the shaded gray area represents the Great Recession of 2008 and 2009).

US Auto Sales data by YCharts.

Autos have long been a bit of a conundrum for value investors. On the one hand, the industry is an oligopoly, with the "Big Three" of Chrysler, Ford and General Motors representing more than two-fifths of the U.S. market in the 11 months to November 2012. Brand management is an important part of the business and is a source of value. Less attractive is the recurring need for substantial capital expenditures to remain competitive. All told, U.S. automakers have struggled mightily to earn their cost of capital on a consistent basis for the past several decades. When auto sales collapsed in 2008 as a result of the credit crisis, only Ford was strong enough to avoid a bankruptcy filing.

Still, there is a bond market adage that says there are no bad bonds -- only bad prices. Similarly, even the shares of cyclical or low-quality businesses are attractive at the right valuation. With Ford and GM trading at 9.1 and 8.5 times earnings-per-share estimates for the next 12 months, their valuations won't prevent the stocks from outperforming the S&P 500 this year (as they did in 2012). As demand continues to build momentum, barring a major economic slowdown, the shares could take off in 2013.

Ford has been performing incredibly well as a business over the past few years: It's making good vehicles, it's consistently profitable, it recently reinstated its dividend, and it has done a remarkable job paying down its debt. But Ford's stock seems stuck in neutral. Does this create an incredible buying opportunity, or are there hidden risks with the stock that investors need to know about? To answer that, one of our top equity analysts has compiled a premium research report with in-depth analysis on whether Ford is a buy right now and why. Simply click here to get instant access to this premium report.

The article As Auto Sales Rev Up, So Could Auto Shares originally appeared on Fool.com.

Alex Dumortier, CFA has no positions in the stocks mentioned above; you can folllow him @longrunreturns. The Motley Fool owns shares of Ford. Motley Fool newsletter services recommend Ford and General Motors Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.