Goodbye, Lost Decade: Stocks at All-Time Highs

If you include dividends, major market indexes such as the S&P 500 and Dow Jones are at all-time highs. Including dividends is the right way to think about market returns, but too many investors don't. They instead focus on the daily trading prices of major indexes. And from that view, stocks are still below their 2007 highs.

But after yesterday's monster rally, two major stock indexes are at all-time highs, even excluding dividends.

First is the Russell 2000 index of small-cap stocks:

Source: S&P Capital IQ.

Someone who bought the Russell 2000 at the very peak of the dot-com bubble in 2000 -- one of the worst times in history to buy stocks -- has since earned a positive return of about 4% per year. And again, that doesn't include dividends.

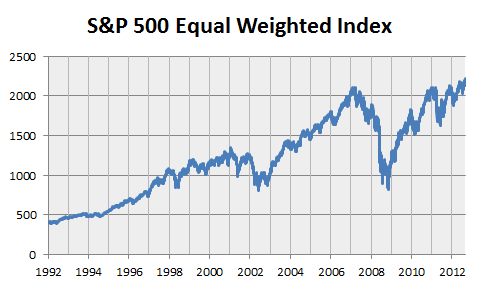

Next is the S&P 500 Equal Weight Index, which holds all 500 components of the famous index in equal amounts, rather than skewed by market cap. It too hit an all-time trading high yesterday:

Source: S&P Capital IQ.

Someone who bought the S&P 500 Equal Weight Index at the top of the market in 2007 has since earned a positive return of around 2% a year, before dividends.

So long, lost decade.

The Motley Fool's chief investment officer has selected his No. 1 stock for the next year. Find out which stock it is in our brand-new free report: "The Motley Fool's Top Stock for 2013." I invite you to take a copy, free for a limited time. Just click here to access the report and find out the name of this under-the-radar company.

The article Goodbye, Lost Decade: Stocks at All-Time Highs originally appeared on Fool.com.

Fool contributor Morgan Housel and The Motley Fool have no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.