The Dow Dividend You Should Own in 2013

2012 is winding down fast, but you still have a couple of hours left to make final portfolio adjustments for the new year. I'm here to show you the Dow Jones dividend champion to own next year.

I'm not going to direct you to the Dow's richest yields. Verizon's 4.8% payout and AT&T's 5.3% yield do look as good as gold if all you want is a strong flow of dividend checks.

But bigger isn't always better, and the telecom industry is fraught with uncertainty right now. Sprint Nextel is about to score a massive cash infusion from foreign investors. Sitting on a suddenly stable cash cushion, the company seems intent to shake up the wireless industry as we know it. That makes Big Red and Ma Bell uncommonly risky bets at the moment. Their dividends are rich and rock-solid, but share prices could drop dramatically if Sprint's bold plans gain traction.

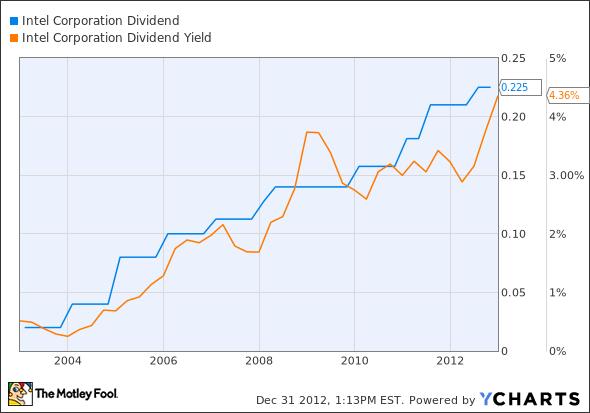

Which brings me to the third-fattest yield on the Dow: microchip titan Intel . This stock already got through an industry upheaval, and investors have left the stock for dead. Intel plunged 16% in 2012, while the Dow gained 6%. That drastic price drop also boosted dividend yields to a record-breaking 4.4%.

INTC Dividend data by YCharts.

If you truly believe that the PC is dead and that Intel has no place on either the server or client side in a post-PC world, then this swoon makes perfect sense. But if you disagree with any one of those assumptions, the conclusion turns upside-down in a hurry.

That's why I recently bought Intel shares with my own hard-won cash. The PC may or may not be dead, but Intel isn't going away. The company may still make its mark on the maturing market of mobile computing, and it's still the undisputed king of the server systems feeding the mobile beast. That's more than enough to support today's 8.9 P/E ratio and jaw-dropping dividend yields.

When it comes to dominating markets, it doesn't get much better than Intel's position in the PC microprocessor arena, but the company must find new avenues for growth. In this premium research report on Intel, our analyst runs through all of the key topics investors should understand about the chip giant. Better yet, you'll continue to receive updates for an entire year. Click here now to learn more.

The article The Dow Dividend You Should Own in 2013 originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Intel, but he holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Intel. Motley Fool newsletter services have recommended buying shares of Intel. Motley Fool newsletter services have recommended writing puts on Intel. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.