3 "Pigs of the Dow" to Buy Now

Not to be confused with "Dogs of the Dow," which focuses on the Dow components with the highest dividend yield at the end of the year, "Pigs of the Dow" aims to fulfill the original intent of the Dogs: identifying the worst-performing stocks of the DJIA from the year before." Pure stock performance is the criterion used to create the list. The general purpose behind each of these approaches is to find the stocks that have languished in a given year and buy them.

Without getting into the pros and cons of mean-reversion portfolio contruction, in the simplest terms, each of these strategies is based on the idea that the underperformers of one year will not be the same in the following year. This means that owning these underperformers will give you the best chance of outperforming the index in the following year. This is particularly convenient for the Dow 30, because there are a manageable number of stocks involved.

Two companies on the Pigs list look appealing heading into 2013; the third name is only an interesting speculative play. Let's discuss each stock and why you should consider including it your portfolio in the year ahead.

Intel

By far my favorite of the three names on this list, Intel has a bright future and is a must-own name for your core portfolio. With shares down 16.5% this year, there is a consensus that the stock represents a solid value. The company has diversified exposure to three critical market segments: PCs, mobile processors, and servers. In 2012, PC processors are expected to account for $31 billion of spending -- about five times the expected size of the mobile-processor market. PCs are definitely declining in importance, but they are hardly trivial. In addition, Intel is expected to release a 4G LTE chip in the first part of 2013, and DigiTimes recently reported that the company is expected to announce a completely new smartphone platform at the Mobile World Congress in late February. Finally, the server market, which represents a $10 billion per-year market segment, is solid home turf for Intel and should be a third part of its growth strategy heading into 2013. Overall, shares look attractive from both the growth and value perspectives, and the stock is an absolute buy here.

McDonald's

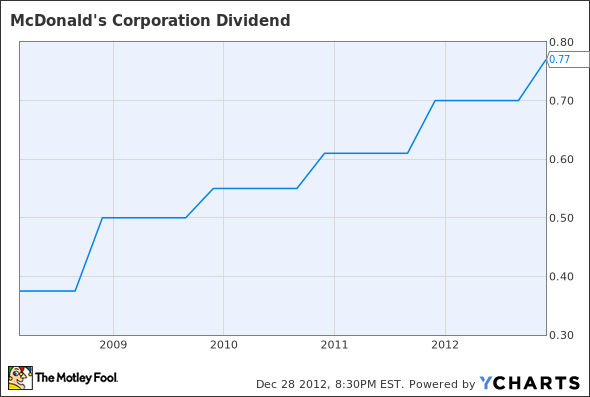

After being the strongest-performing stock in the Dow in 2011, McDonald's is down nearly 13% this year. Despite its struggles, the company remains essentially unrivaled in terms of reach or size; with McDonald's market capitalization near $90 billion, closest competitor Yum Brands is only a third of the size at about $30 billion. The stock carries a dividend yield of 3.5% and has a strong history of steadily increasing its dividend (see chart below). Furthermore, the company continues to press to make its menu more healthy. The ability of management to add apples to a happy meal and revamp the company's image is a trick worth buying into. Overall, the company and the stock are well-positioned for 2013, and I'm a buyer here.

MCD Dividend data by YCharts.

Hewlett-Packard

With Friday's 2.5% sell-off, H-P is off nearly 48% for 2012 with only one trading day left in the year. At the heart of the continued slide was the announcement that, in addition to all of the other challenges the company is facing, HP would need to take an $8.8 billion writedown as a result of the acquisition of software maker Autonomy in 2011. The company also disclosed in its annual report that the Department of Justice has opened an inquiry relating to Autonomy. The New York Timeswrote that the report "discusses the methodology it employed when making the $8.8 billion charge, but it did not break out exactly how the purported accounting improprieties were behind $5 billion of that charge." The lack of specificity is not a positive sign, especially when the data is included in a supposedly comprehensive annual report or when the company is in the midst of a multiyear rebuilding phase and needs shareholder patience.

Given all of the above, you might wonder how this stock could possibly make anyone's list of recommendations. With shares carrying a forward P/E of 3.9, one could argue that at current levels, the company is a deep value play.ut considering the maelstrom or problems surrounding HP, this would seem naive at best. I like this name only as a speculative play on the belief that the company will survive and find a way to prosper in the future. A small allocation may have long-term appeal, and I favor paying attention to household names that have been all but abandoned. Believe it or not, Apple once fell into this category.

When it comes to dominating markets, it doesn't get much better than Intel's position in the PC microprocessor arena. However, that market is maturing, and Intel will be in a precarious long-term situation if it doesn't find new avenues for growth. In this premium research report on Intel, our analyst runs through all of the key topics investors should understand about the chip giant. Better yet, you'll continue to receive updates for an entire year. Click here now to learn more.

The article 3 "Pigs of the Dow" to Buy Now originally appeared on Fool.com.

Fool contributor Doug Ehrman has no positions in the stocks mentioned above. The Motley Fool owns shares of Apple, Intel, and McDonald's. Motley Fool newsletter services recommend Apple, Intel, and McDonald's. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.