Will PNC's Dividend Jump in 2013?

PNC Financial Services has become one of the biggest regional lenders in the U.S. through a series of acquisitions over the years. Although it isn't yet the size of some of its megabank rivals like Bank of America or Wells Fargo , its steadily growing power and its improved results boost the possibility that it'll raise its dividend. What are the chances that'll happen in 2013?

Always in the market

PNC is one of the most acquisitive regional banks out there. It's gotten to its present fat size due almost entirely to buyouts. The most recent one was its purchase of the American assets of Royal Bank of Canada, RBC Bank (USA), which it consolidated into results earlier this year.

That cost PNC a bit under $3.5 billion, which it said was under RBC Bank's tangible book value. Not only did the company get a good deal, the Pittsburgh-based company in a single move became a presence in the South, the home of all of its new acquisition's 420-plus branches.

That was only the latest in a very long string of buyouts for PNC, a patient long-view operator that likes to work its strategy carefully and deliberately before going in for a strike. That strategy has put the company where it is these days, which is at No. 2 on the list of largest regional banking groups in terms of branches. At nearly 3,000 strong, it's eclipsed only by US Bancorp .

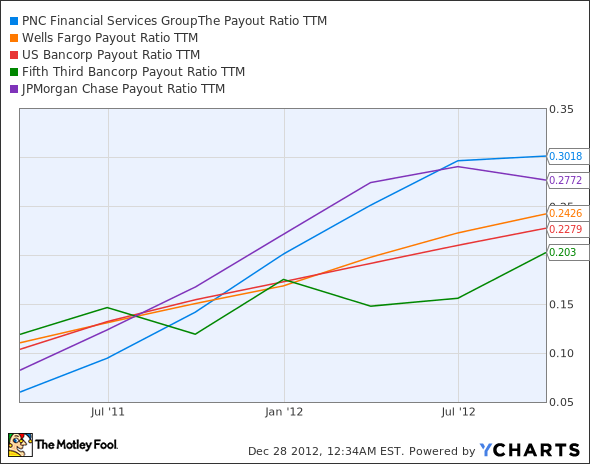

Considering that, you might expect the company to be fairly stingy in its dividend policy. Actually, it's not. If we match its payout ratio against a group of other banking majors -- Wells Fargo, US Bancorp, JPMorgan Chase, and fellow Rust Belt regional Fifth Third Bancorp it comes out ahead, and is the only one that crosses the .30 frontier:

PNC Payout Ratio TTM data by YCharts.

No funny stuff here

One big reason PNC can do so is because, despite those headline-grabbing acquisitions, the bank is at heart a fairly traditional lender.

For evidence, look at its most recent 3Q; corporate and retail banking was responsible for a full three-quarters of revenues. None of the company's other business units -- unfortunately including current industry high flyers like asset management and residential mortgages -- contributed more than a few percentage points to the total.

That conservatism served PNC particularly well during the financial crisis years, when it was one of the few banks that stayed liquid and profitable. So it likely could have survived without using TARP bailout money. It took the help anyway, and guess what it did?

That's right, it went shopping. The acquisition in that case was National City and it became one of the habitual acquirer's biggest acquisitions, at $5.2 billion.

It's pretty easy to sense a pattern here. PNC amasses a pile of money and rushes to the store if there's a sale. With the change it always seems to come home with, it doles out money to its partners. This is one financial that doesn't pump money into any expense it's not comfortable with. The other guys can have the shiny investment banks, or the big positions in derivatives, thank you very much.

April showers bring...

So should we expect anything from PNC in terms of a dividend hike? On the surface of it, there's no profoundly compelling reason for it to fatten its payout in order to pull up the share price. PNC stock currently trades at the low-ish end of its 52-week range, but not to the point of concern.

And at the moment, the P/E of the shares is 11.8 -- right around the 11.4 average for banks. That's not too hot or too cold; Bank of America currently stands at a bloated 31.0, US Bancorp matches the sector at 11.4, while Wells Fargo, JPMorgan, and Fifth Third are moderately cheaper at 10.8, 9.3, and 9.7, respectively.

But a glimpse at its dividend history reveals an interesting fact: in every year since 2006, with only a single exception, the company has adjusted its quarterly payout beginning with its 1Q results. This dividend is paid in April. And the amount of the cut or increase is sharper than the decline or growth in net profit.

For example, 2008's bottom line slid by 40% from the previous year; the dividend cut in April 2009 was 85% (from $0.66 per share to $0.10). On the other hand, 2011's net crawled up only 0.5%, yet the company boosted its dividend by 14%.

Will the bank follow this path in 2013? It seems likely. After all, it's a creature of tradition and habit. It's been doing well lately in terms of operations, and there don't seem to be a great number of takeover candidates hanging on the shelf at the moment.

This combination of improving (steadily, of course!) results -- thanks in no small part to the RBC Bank consolidation -- and the relative dearth of attractive takeover candidates potentially means more spending cash on hand... and, therefore, more to share with investors.

So does this mean PNC is an irresistible buy? To help you figure that out, one of The Motley Fool's top banking analysts has authored a premium research report, delving into everything investors need to know about the bank today. To claim your copy, simply click here now for instant access.

The article Will PNC's Dividend Jump in 2013? originally appeared on Fool.com.

Eric Volkman has no positions in the stocks mentioned above. The Motley Fool owns shares of Bank of America, Fifth Third Bancorp, PNC Financial Services, and Wells Fargo. Motley Fool newsletter services recommend Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.