Does Lilly's Lineup Make the Grade?

As we change out our 2012 calendars for new ones in a few days, many investors will also look at possibly changing what stocks are in their portfolios. Should Eli Lilly be part of that rotation?

To help with your evaluation process, the Fool is kicking off a series where we will examine Lilly in detail to see if it makes the grade for individual investors. We turn our microscope first on the pharmaceutical company's current product lineup.

Balance

One key area that investors should focus on when looking at a pharmaceutical company's product lineup is its balance, or lack thereof. A company that is highly dependent on only one drug can be a riskier proposition than another firm with several strong products.

Lilly scores a solid "B" in this category. The chart below shows the weighting of the company's current drugs.

Source: Company 10Q Report.

Cymbalta clearly stands out as the lead drug for Lilly with 22% of total net product sales. However, the company isn't overly dependent on the drug. Several others contribute strong sales, with Alimta, Humalog, Cialis, and Zyprexa garnering over $1 billion in sales in the first nine months of 2012.

Lilly does relatively well in another type of balance also. The company's U.S. revenue in the first nine months of 2012 totaled $9.1 billion compared to $7.6 billion from international sales. That reflects a 55% to 45% slight skew toward U.S. sales, which isn't bad.

Growth

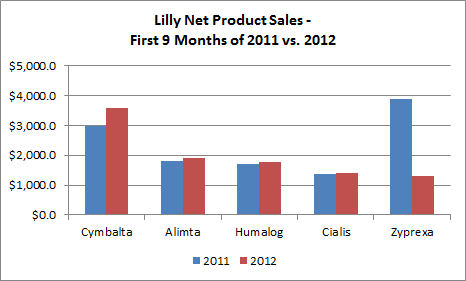

A company can have a well-balanced product portfolio, but that means little if most of the drugs are experiencing declining sales. How does Lilly's lineup look from a growth standpoint?

Source: Company 10Q Report.

The scorecard is mixed for Lilly's upper tier of drugs. Cymbalta's sales grew 20% in the first nine months of 2012 compared to 2011. On the other hand, Zyprexa's sales fell 66% during the same period due to loss of patent protection. Meanwhile, the company's other top drugs experienced growth in the low single digits.

What about the other Lilly drugs? The verdict is still mixed.

Source: Company 10Q Report.

Effient sales soared 59% in the first nine months of 2012 compared to the prior year. Forteo and Lilly's animal health products grew 22%. Several other drugs, though, experienced slight losses or minimal growth. The catch-all category of all other drugs actually lost ground considerably, with 2012 sales from the first three quarters down 19% compared to 2011.

Overall, Lilly's revenue increased 9% during the first nine months. That's not bad, but it's not great. I give Lilly a "C" for growth.

Risk

Potential for future growth means more to investors than past growth. Unfortunately, risks abound in the pharmaceutical industry that could hamper future growth. One significant area of risk is in patent expiration.

Lilly faces serious risks related to loss of patent protection. Its current top-selling drug, Cymbalta, goes off-patent in 2013. Patents also expire for Humalog, which is No. 3 in sales for 2012. Evista loses patent protection in 2014.

The first patent for Alimta expires in 2016. However, litigation is under way with several companies, including Teva Pharmaceuticals , that want to make generic versions of the drug even sooner.

There is also the risk from stronger competition. Cialis already battles against Pfizer's market leader Viagra. Earlier this year, Vivus received FDA approval for another erectile dysfunction drug, Stendra, which could gain traction. Lilly's fast-growing Forteo also faces strong rivals in Amgen's Prolia and Merck's Fosamax.

With these patent and competitive challenges, Lilly's grade for risks associated with its current portfolio is a "D." The bad news is that grade could get worse before it gets better.

Overall grade

While Lilly gets a "B" for its balanced portfolio and a "C" for growth, the risks that the company faces weigh heavily. In fact, those risks are such that they drag down the overall grade for Lilly's current product lineup to a "D."

There are more factors to consider when investing in a pharmaceutical company than just its current products, though. Over the next few days, we'll look at several other key areas to see if Lilly makes the grade for inclusion in your basket of stocks.

Eli Lilly will see nearly $0.40 of every $1.00 in sales exposed to generic competition over the next few years. How does the company plan to respond to this huge patent cliff? Better yet, what does this mean for investors? In a bra-new premium report on Eli Lilly, The Motley Fool's top pharmaceuticals analyst delves into everything investors need to know about the stock today. Simply click here now to claim your copy.

The article Does Lilly's Lineup Make the Grade? originally appeared on Fool.com.

Keith Speights has no positions in the stocks mentioned above. The Motley Fool has no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.