Will RIM Follow the Road Less Taken?

Let me tell you a little story. Keep your tissues handy, because it really doesn't have a happy ending.

A fallen giant in the mobile computing industry needs a miracle to survive. Winding up for one last Hail Mary, the company prepares a totally new smartphone software platform, built by respected gurus in the field and based on solid technology. In the months leading up to the final release, product photos and tantalizing details start to leak out. Fans are abuzz, rivals fidget nervously, and share prices surge.

What happens next?

There goes my hero

Research In Motion fits the description above. Investors and management alike hope for a triumphant return to the smartphone market that RIM's BlackBerry line once helped create. The long-awaited BB10 platform has a lot riding on its shoulders. Will the $200 million spent onHarman International Industries' QNX division finally bear fruit and save the day? Or is it too little, too late?

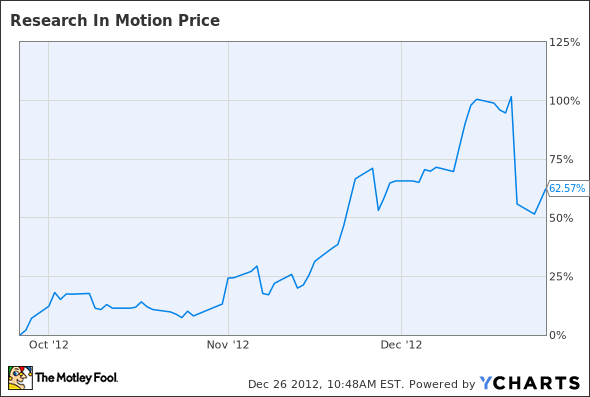

Like I said, the stock is surging on pre-release enthusiasm. Another weak earnings report took the shine off the charge, but RIM shares have still gained 62% in the last three months. Isn't this proof positive that the company's fortunes have turned?

I'm afraid there's ample and recent evidence to the contrary. Remember Palm?

Where's the road less taken?

Like BB10, Palm's Pre smartphones and Linux-based WebOS software had the buzz of a thousand beehives. The company was in dire straits, but the rickety balance sheet and negative earnings would surely be saved by this dynamic duo.

So Palm Pre launched to rave reviews -- and forgettable sales. A year later, investors counted their blessings as Hewlett-Packard bought the company for pennies on the dollar. Now, WebOS has been released as an open-source package with zero commercial value and HP jettisoned what was left of Palm's leadership.

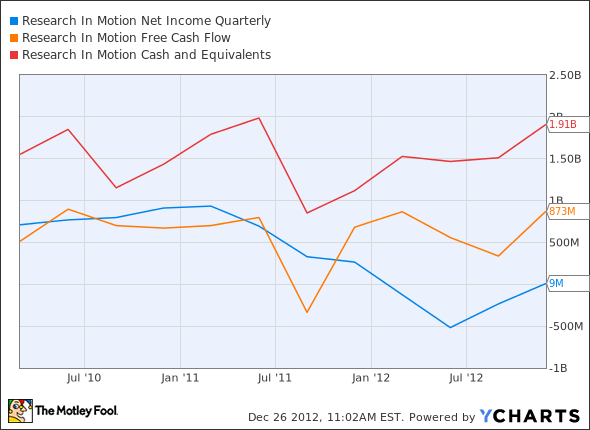

What's different this time? Well, RIM stands a few feet further away from its personal fiscal cliff than Palm did at the end. The company has nearly $2 billion in the bank and no long-term debt, and has been known to turn the occasional profit. Cash flows still look pretty strong. Palm didn't have these advantages.

RIMM Net Income Quarterly data by YCharts.

But RIM also finds itself in a far more mature mobile market. The Apple iPhone was but two years old when the Palm Pre hit store shelves and Google's Androids had barely outgrown their diapers. Now, Apple has reported 271 million iPhones sold, not counting the as-yet untold millions of units shipped in the current holiday quarter. Even Cupertino fights an uphill battle against the Android army. Mighty Microsoft , with former cell phone king Nokia tightly by its side, can hardly make a dent in the firmly established iPhone/Android duopoly.

The best man doesn't always win

What I'm trying to say is, BB10 may be the best thing since sliced cake and more beautiful than a Caribbean sunset. It doesn't really matter. The best technology doesn't always win, or else we'd still care about Palm products today.

A BlackBerry turnaround isn't completely impossible, but it's highly unlikely given the state of the mobile industry. I'd expect RIM's share to climb some more until the product actually launches. And that's likely to be the end of the good news.

In other words, I see RIM hitting a final peak in January or February of 2013. It's all downhill from there. I even have a thumbs-down CAPScall riding on that endgame. That's about the strongest bearish statement you'll see a Fool make, next to actually shorting the stock or buying put options.

2013 and beyond

There's no doubt that Apple is benefiting handsomely from the smartphone revolution started by RIM. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on both reasons to buy and reasons to sell Apple, and what opportunities are left for the company (and more importantly, your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

The article Will RIM Follow the Road Less Taken? originally appeared on Fool.com.

Fool contributor Anders Bylundowns shares of Google but holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Google and Apple. Motley Fool newsletter services have recommended buying shares of Google and Apple. Motley Fool newsletter services have recommended creating a bull call spread position in Apple. Motley Fool newsletter services have recommended creating a synthetic covered call position in Microsoft. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.