Fiscal Cliff: What Does It Mean for Energy Stocks?

We're less than two weeks from going off the so-called fiscal cliff and it's time to start paying attention to the consequences. Up until the violent reaction today, stock markets haven't reacted negatively to the drawn out negotiations, but that all changed after the symbolic "Plan B" failed before it could even be voted on.

Everyone will be affected by the fiscal cliff in one way or another, whether we go over it or whether a potential deal is made, and investors need to prepare for the possibilities. Below I've outlined some of likely ways the fiscal cliff will impact energy companies in the next year -- deal or no deal.

The inevitable recession

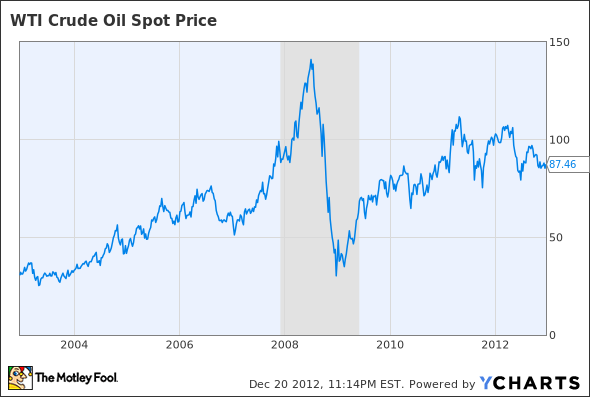

Let's start with the obvious reactions to careening over the fiscal cliff. If we go over the cliff the Congressional Budget Office has predicted that we'll head back into a recession and unemployment will rise to 9.1% by the end of 2013. The last time we went into a recession the price of oil dropped from $140/barrel to $40 per barrel almost overnight. A similar, albeit less violent, reaction can be expected if we go over the cliff.

WTI Crude Oil Spot Price data by YCharts

Oil isn't at the same high it was in 2008 but it's already started sinking well below $100/barrel, which was once a "normal" price. If we go into another recession we could see oil sink further toward $50/barrel, which would have a big effect on the industry.

This would have a negative effect on the oil drilling taking place in the U.S., which would also have a negative effect on employment. Shale oil is far costlier to produce than oil in Saudi Arabia or traditional drilling in Texas, for example. Richard Sears, a former executive at Royal Dutch Shell estimates that shale oil becomes economical around $50-$60 per barrel, not inconceivable if we go into a recession.

Shale drillers like Kodiak Oil & Gas , Continental Resources , and Whiting Petroleum all have cash costs well below the current price of oil for existing wells, so the taps won't shut off from existing wells but new wells would quickly come under pressure. Kodiak Oil & Gas had a $56.79 per barrel cash margin last quarter and that needs to pay for capital expenditures for the capital cost of drilling wells as well as investors' profits. A drop of another $20 or $30 per barrel could bring shale drilling to a screeching halt in the U.S.

If we go off the cliff then the production tax credit will also end for the wind industry. This could bring wind installations to a halt, affecting manufacturers like GE and Siemens as well as a plethora of installers. Wind has accounted for a lot of the new electrical generation in the U.S. over the last decade, so this is a bigger impact than you may think.

What if we go over the cliff and don't go into a recession?

GDP growth has held up surprisingly well going into the fiscal cliff so the consensus prediction that we'll go into a recession may not come true. In that case, oil prices may not plummet and most energy companies would be left largely unscathed. The reduced budgets of the EPA and the Energy and Interior departments may even be seen as positives. Going over the cliff may actually be better than a compromised deal if we manage to avoid a recession, because of the ramifications of a potential deal.

A done deal: tax loopholes the first to go

We know that the president and Congress will agree to revenue increases but we don't know exactly what they'll look like in the end. There are a number of oil and gas loopholes that could be closed to raise revenue that would have an effect on a broad number of companies in the energy industry.

Big oil would be the first target of corporate tax reform. ExxonMobil , Chevron , and ConocoPhillips have been recording billions of dollars in profits every quarter and they're an easy target for a government looking for revenue. Look for the percentage depletion rule, the 2004 domestic manufacturing deduction, expensing of drilling cost, and potentially other loopholes to be on the cutting board for oil companies under any compromise.

A drastic change to the energy sector

I'm going out on the limb here, but a wild card in the negotiations is the possible addition of cap and trade. The concept of taxing emissions in some way has been bandied about for years but it's times like this that the political will may actually take shape to pass legislation. California's brand new cap and trade system will take effect on Jan. 1 and a similar mechanism could be slipped into last minute fiscal cliff negotiations.

The impact of cap and trade as a revenue source for the government could be significant. UPI and InsideClimate News estimates that California will generate $660 million-$3 billion in the first year of the new cap and trade program. The federal government could generate multiples of that on a larger scale. Add up 10 years of budget projections and you have a real negotiating tool to tackle the fiscal cliff.

But what would a tax be without a little spending? If cap and trade does go through it's certain Obama would use the money to fund alternative energy projects. First Solar and SunPower have been two of the beneficiaries of solar programs but few of the companies funded directly have lasted the test of time. As two of only a few survivors of the past few years these companies could benefit from federal funding of clean energy under cap and trade. A greater impact may be felt by companies working on energy efficiency to help companies avoid the caps.

Foolish bottom line

The energy sector will feel the effect of the fiscal cliff whether we go over it or whether we come to some sort of resolution. If we go off the cliff then oil and gas companies will be hit by lower demand and may stop drilling wells that would become uneconomical under lower energy prices. This impacts everyone from explorers to service companies like Halliburton and Schlumberger .

If we don't go over the cliff there could be significant policy changes for energy. A number of political proposals that have only been pipe dreams in recent years could become reality in an effort to find revenue without raising tax rates. This means the likelihood of closing loopholes for oil and gas companies who have enjoyed preferential treatment for decades. An even more extreme scenario could see the addition of cap and trade, a paradigm shift for manufacturers, energy producers, utilities, and all sorts of companies across the industry.

One solid energy play

There are many different ways to play the energy sector, and our analysts have uncovered an under-the-radar company that's dominating its industry. This company is a leading provider of equipment and components used in drilling and production operations, and poised to profit in a big way from it. To get the name and detailed analysis of this company that will prosper for years to come, check out our special free report: "The Only Energy Stock You'll Ever Need." Don't miss out on this limited-time offer and your opportunity to discover this under-the-radar company before the market does. Click here to access your report -- it's totally free.

The article Fiscal Cliff: What Does It Mean for Energy Stocks? originally appeared on Fool.com.

Fool contributor Travis Hoium owns shares of SunPower and has the following options: long JAN 2015 $7 calls on SunPower and long JAN 2015 $5 calls on SunPower. The Motley Fool owns shares of General Electric Company, Halliburton Company, and ExxonMobil. Motley Fool newsletter services recommend Chevron, First Solar, and Halliburton Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.