3 Sectors to Watch in 2013

On December 21, the world is supposed to end. But just in case humanity survives, there's a lot of civilization-building still to be done. Here are three sectors tossed and turned in 2012 that deserve a watchful eye in 2013.

1. Housing

If there's one word that sends chills down investors' backs, it's "housing." But despite the bears' best efforts, housing has been on the rebound for most of 2012.

National Association of Homebuilders Chairman Barry Rutenberg put it simply:

In view of the tightening supply and other improving conditions, many potential buyers who were on the fence are now motivated to move forward with a purchase in order to take advantage of today's favorable prices and interest rates.

The recovery may be slow, but people know a deal when they see one.

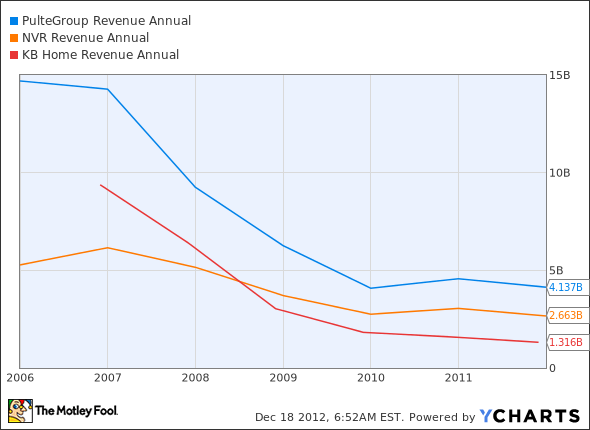

To get in on the ground floorplan, consider these stocking stuffers for 2013. PulteGroup , NVR , and KB Homes have soared in the last year, but long-term investors could still see lots of upside.

Sales for all three companies have been stuck in the basement, even as America regains confidence and doles out dollars. All three stocks sport seemingly pricey P/E ratios, but there's exponentially more "E" to be made in the coming years.

PHM Revenue Annual data by YCharts

2. Automakers

Auto manufacturers received the global shakedown of their lives in 2012. Europe an sales fell to a 19-year low, China continues to rocket records, and the U.S. remains skittish on sales.

Investors will need to watch the E.U. with a wary eye next year, but being bullish in China might pay off more than being bearish in Europe. A recent McKinsey report estimates that China auto sales will grow at an 8% annualized rate through at least 2020 .

For investors who want a piece of China's pie with built-in risk protection, American automakers provide a unique entry point into this newly-tapped market. In the past two years, the world's top 10 automakers have poured more than $38 billion into China , and it's paid off.

In November, Ford broke China sales records for the third straight month, up 56% from its 2011 numbers. The Ford Focus is one of the best-selling passenger cars in China, and the blue oval plans to introduce 15 new vehicles in China by 2015 .

GM isn't sitting on its haunches, either. The automaker exceeded average industry growth for 2012, and plans to have invested $7 billion in China between 2010 and 2015. Buick sales recently climbed, and GM will focus on increasing its Cadillac presence in 2013.

3. Utilities

December 31, 2012 might end up being the most important financial day of the year, when Congress decides whether or not to jump off the fiscal cliff. In the past few months, utility stocks have been hammered, as investors question whether their dividend-dealing business models will survive proposed tax hikes.

But I ran the numbers, and things aren't as doomy and gloomy as mainstream media would have us believe. Americans are still going to use electricity and, if other signs of an economic recovery are any indicator, they're going to use more in the future than they have in the recent past.

Companies like Exelon , Duke Energy , and NextEra Energy are spending wisely by upgrading costly generation plants and diversifying their energy portfolios. Dividends are just one way for a company to return value to its shareholders, and Exelon recently announced it's reorienting its business strategy to cut back on its 7.1% yield . That type of announcement can put a company on the short track to Wall Street shorts, but may ultimately be in the best interest of Exelon and its shareholders.

Foolish bottom line

Hindsight's 20/20, and it's easy enough to reflect on 2012's trends -- now that it's over. Keep these three sectors on your watchlist for 2013, and develop your investing thesis before Wall Street realizes what they've missed.

Utilities: Add Exelon, Duke Energy, and NextEra Energy to my Watchlist.

As the nation moves increasingly toward clean energy in 2013 and beyond, Exelon is perfectly positioned to capitalize on having the largest nuclear fleet in North America. Combine this strength with an increased focus on renewable energy, and EXC's recent merger with Constellation places Exelon and its best-in-class dividend on a short list of top utilities. To determine if Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

The article 3 Sectors to Watch in 2013 originally appeared on Fool.com.

Justin Loiseau has no positions in the stocks mentioned above. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool owns shares of Ford. Motley Fool newsletter services recommend Exelon, Ford, and General Motors Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.