How Disney Crushed the Dow in 2012

Walt Disney had a banner year in 2012.

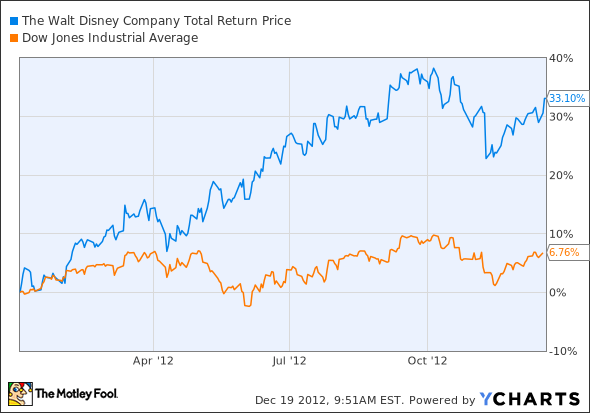

The House of Mouse started the year in first gear, outperforming but not embarrassing its Dow Jones peers for a few months. Then The Avengers hit the silver screen, breaking records and instantly validating the long-term value of the $4 billion Marvel acquisition. Disney has absolutely crushed the Dow since then. The stock set brand-new all-time highs this year.

DIS Total Return Price data by YCharts.

Investors didn't exactly jump for joy when Disney agreed to buy Lucasfilm in October. It's another big, bold, $4 billion bet on established content, like the game-changing Marvel and Pixar deals in years past. Disney has managed its computer-generated cartoons and superhero properties to near-perfection, and there's no reason to believe the story will be any different with Star Wars and Indiana Jones.

Elsewhere, theme park attendance nudged up, and Disney broke ground on a new park in Shanghai, set to open in 2015. Sports network ESPN signed long-term deals to cover Wimbledon, MLB baseball, and the BCS college football series. And if you still need proof that Disney is thinking ahead, the company recently signed a long-term distribution deal with digital-media maven Netflix . This contract would normally go to a premium cable channel such as HBO, Showtime, or Epix, but Disney saw better value in a totally cable-free alternative. Smart move.

But not everything Disney touches turns to instant gold. John Carter flopped on an epic scale this spring. The ABC TV network delivered lower ad sales in the recently reported fourth quarter. When Nielsen revealed the top 10 TV events of the year, ABC wasn't even on the list. Dancing With the Stars was the network's only presence among the most-watched weekly shows (though ESPN helped out with the NFL's Monday Night Football schedule).

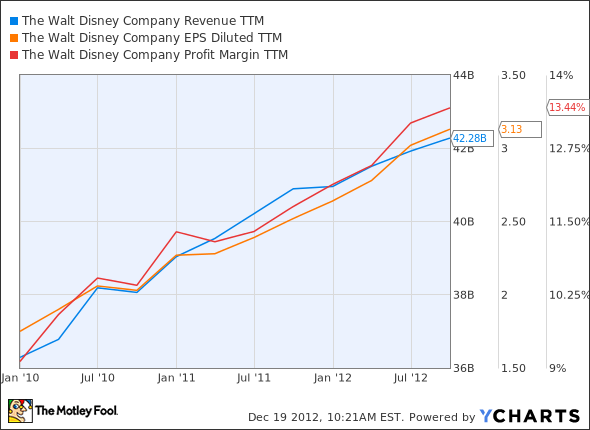

It's hard to find fault with Disney's long-term strategies. The company simply grows stronger every day.

DIS Revenue TTM data by YCharts.

It's easy to forget that Walt Disney is more than just the House of the Mouse. True, Disney amusement parks around the world hosted more than 121 million guests in 2011. But from its vast catalog of characters to its monster collection of media networks, much of Disney's allure for investors lies in its diversity, and The Motley Fool's new premium research report lays out the case for investing in Disney today. This report includes the key items investors must watch, as well as the opportunities and threats the company faces going forward. We're also providing a full year of regular analyst updates as news develops, so don't miss out -- simply click here now to claim your copy today.

The article How Disney Crushed the Dow in 2012 originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Netflix and has created a bull call spread on top of that position, but he holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Walt Disney and Netflix. Motley Fool newsletter services have recommended buying shares of Netflix and Walt Disney. Motley Fool newsletter services have recommended creating a bear put ladder position in Netflix. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.