Verizon Looks Back on a Fantastic 2012

To Verizon Communications , 2012 was a year for the record books. The stock set all-time highs again, backed by the richest cash flows the telecom king has ever seen:

VZ Total Return Price data by YCharts.

The telecom sector is booming in general. Verizon and AT&T crushed their Dow Jones peers this year. Smaller rival Sprint Nextel skyrocketed even higher thanks to a turnaround story based on smartphones and high-speed data connections. Verizon's story is similar, except the company didn't have a near-death experience in 2011, as Sprint did. Instead, the company is building a long-term success story, brick by boring brick. Sprint might be exciting, but Verizon is the kind of reliable performer that builds wealth while helping you sleep at night.

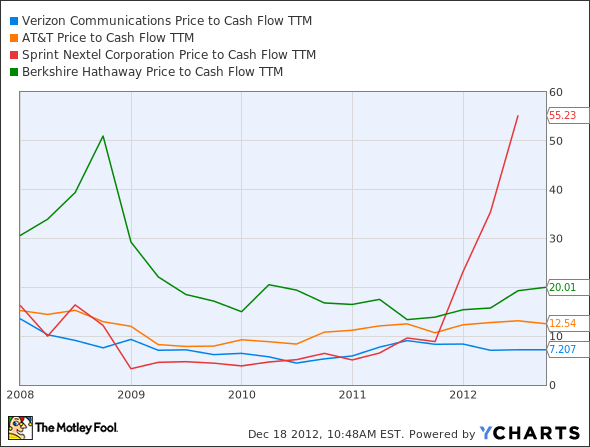

These gains still leave plenty of room for further growth. You pay just $7.20 for every dollar of Verizon's free cash flow. That's the kind of deep discount that makes value investors reach for their wallets. Let's put the ratio in the context of telecom rivals and a familiar value-hound favorite:

VZ Price to Cash Flow TTM data by YCharts.

The wireless industry is not without challenges, of course. The tablet and smartphone gold rush is reaching a more mature stage now, leaving less low-hanging fruit for Verizon and friends. And it's a sector in constant flux. AT&T recently tried and failed to buy out T-Mobile USA. Sprint appears well on its way to a major cash infusion from Japanese peer Softbank -- and a subsequent merger with data network operator Clearwire . T-Mobile found another partner in MetroPCS . The pack of smaller networks chasing Ma Bell and Big Red just isn't going away.

The mobile revolution is still exciting, but with so many different companies, it can be daunting to know how to profit in the space. Fortunately, The Motley Fool has released a free report on mobile named "The Next Trillion-Dollar Revolution" that tells you how. Inside the report, we not only describe why this seismic shift will dwarf any other technological revolution before it, but we also name the company at the forefront of the trend. Hundreds of thousands have requested access to previous reports, and you can access this new report today by clicking here -- it's free.

The article Verizon Looks Back on a Fantastic 2012 originally appeared on Fool.com.

Fool contributor Anders Bylund has no positions in the stocks mentioned above. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool has no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.