Nasdaq Shuffles Its Premium Index Cards: Who's In and Who's Out?

Market indexes aren't carved in stone. They're updated to reflect changing market conditions, some more often than others.

This week saw a heavy reshuffling of the Nasdaq-100 list, which aims to track the largest non-financial stocks traded on the Nasdaq exchange. It's an annual overhaul that takes place at the quadruple witching hour in every December, meaning that the changes take effect as option contracts expire this Friday.

I said it was a big change: The governing board removed and replaced 10 of the 100 constituent stocks -- a 10% turnover. By contrast, the index replaced only five stocks last year as well as seven each in 2010 and 2009..

So who's in and who's out? Glad you asked.

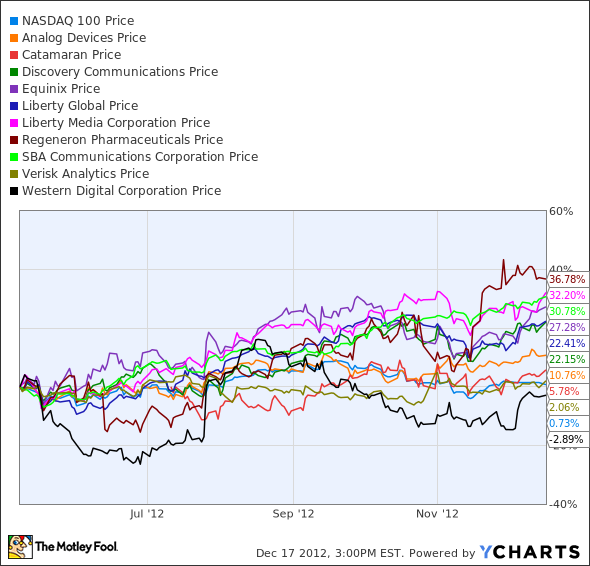

The 10 new additions this year include hard drive builder Western Digital , biotech veteran Regeneron Pharmaceuticals , and data center operator Equinix . Nine of these 10 additions have outperformed the current Nasdaq-100 roster in 2012:

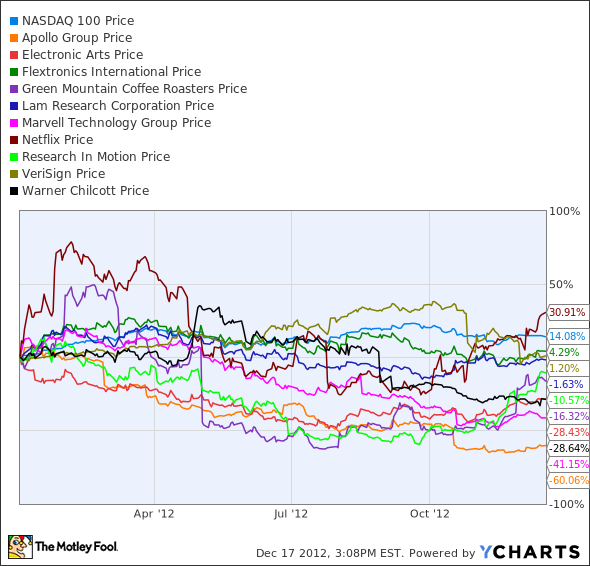

The list of subtractions is a veritable who's who of 2012 controversy. Here, you'll find Keurig K-Cup vendor Green Mountain Coffee Roasters rubbing shoulders with digital video guru Netflix and fallen smartphone favorite Research In Motion . Each of these stocks carries a cloud of uncertainty around, like a personal thunderhead of market volatility. Again, nine of the 10 names moved in the same direction -- but they fell behind the Nasdaq-100 index this time:

Falling out of this exclusive club is by no means a death sentence, nor does every new addition automatically thrive. But major index lists are a great starting point for further research, and veritable hordes of investment vehicles are directly based on every market index. The popular PowerShares QQQ Trust is a direct reflection of the Nasdaq-100 list, for example.

The precipitous drop in Netflix shares since the summer of 2011 has caused many shareholders to lose hope. Can Netflix fend off burgeoning competition, and will its international growth aspirations really pay off? These are must-know issues for investors, which is why we've released a brand-new premium report on Netflix. Inside, you'll learn about the key opportunities and risks facing the company, as well as reasons to buy or sell the stock. We're also offering a full year of updates as key news hits, so make sure to click here and claim a copy today.

The article Nasdaq Shuffles Its Premium Index Cards: Who's In and Who's Out? originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Netflix and has created a bull call spread on top of his shares, but he holds no position in any other company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of Netflix and Western Digital. The Fool owns shares of and has created a long put position on Green Mountain Coffee Roasters. Motley Fool newsletter services have recommended buying shares of Green Mountain Coffee Roasters and Netflix. Motley Fool newsletter services have recommended creating a bear put spread position in Green Mountain Coffee Roasters as well as a bear put ladder position in Netflix. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.