The Best and Worst Internet Stocks of 2012

With the new year just around the corner, there's never been a better time to review the best and worst stocks of 2012. It was a particularly strong year for Internet IPOs. From Facebook's botched public offering to Groupon's accounting issues, tech investors have endured a wild ride. Today let's zero in on these Internet stocks to uncover which companies returned the most and least to shareholders this year.

And the winners are...

The professional social network LinkedIn continues to surprise me. The stock has returned nearly 80% to shareholders year to date, and currently trades around $112 a share. Only 25% of the company's revenue comes from advertising, which is important because of the cyclical nature of ad budgets. This paired with a strong network effect suggest LinkedIn will be able to maintain its lead position in the years ahead.

However, the stock isn't cheap. Shares currently trade at a price-to-earnings ration of 753, compared to an industry P/E of 28. The company's price-to-sales is also discouraging at nearly 15. Therefore, I'd wait for the valuation to become more reasonable before picking up shares of LinkedIn. In the meantime, there are plenty of other attractive opportunities when it comes to Internet stocks.

Online marketplace eBay has also soared this year thanks to strength from its PayPal business. The stock is up more than 66% year-to-date and shows no sign of slowing down. The company's third-quarter revenue spiked 15% to $3.4 billion, as eBay continued to generate significant growth in both its payments business as well as its online marketplace business.

Looking to the future, eBay is heavily investing in mobile technology. In fact, the company's smartphone applications have been downloaded more than 100 million times worldwide. Meanwhile PayPal, which is eBay's fastest-growing business, "is now accepted by more than 60 of the top 100 retailers in the United States," according to research from Morningstar.

Given these catalysts and eBay's momentum heading into 2013, I believe the stock is as much a buy today as it was at the start of 2012. Amazon is another highflier this year. The stock is up nearly 44% year to date, despite the company reporting a loss for its third quarter. Amazon reported a third-quarter loss of $0.60 a share, compared to a $0.14 share gain in the year-ago period.

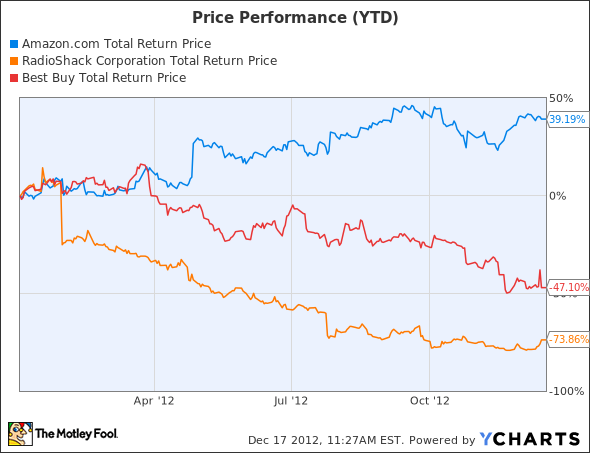

Nevertheless, the e-tailer remains focused on growth even if that means sacrificing near-term profitability. Amazon continues to beat competitors such as Radio Shack and Best Buy by offering the lowest possible prices and convenient shipping through its Prime membership. For comparison, the chart below outlines the total price return for these stocks relative to Amazon.

AMZN Total Return Price data by YCharts.

In 2013, investors should start to see Amazon's investments in its infrastructure and Web services start to pay off. For this reason, current shareholders would be wise to hold the stock for many more quarters to come. Now let's take a look at some of this year's Internet laggards.

This year's losers

As for those stocks that have left much to be desired throughout the year, Groupon is by far the biggest disappointer. The stock has lost more than 76% of its value year to date. The daily deals site, which went public November of last year at $20 a share, now trades around $4 per share. But make no mistake: this is not a buying opportunity.

Aside from operating in an industry with little barrier to entry, Groupon struggles with accounting issues. In fact, since going public last year, the company has had to reinstate earnings twice. Most recently, the company misleadingly slid some operating costs under the rug, which negatively affected Groupon's fourth-quarter operating income by $30 million. I can't imagine investors will buy into a company they don't trust.

Moving on, Zynga comes in at a close second, with the stock down more than 73% year to date. Admittedly, the social game developer has been my worst stock pick to date.

As it stands, Zynga generates a majority of its revenue from Facebook. This means that much of the company's future success hinges on its ability to expand from a Web game maker to a multiplatform game maker. Investors should stay on the sidelines for now as Zynga focuses on cutting costs and becoming less reliant on Facebook.

Speaking of the world's most popular social network, shares of Facebook are down nearly 30% year to date. The company hit the public market on May 18, with shares priced at $38 apiece. Today the stock trades around $26 a pop. Like so many investors, I want to see Facebook make meaningful inroads into mobile before I invest in the company.

I should point out that Facebook's third-quarter results were upbeat. Mobile was a particular bright spot in the earnings report, with mobile users increasing 61% from the year-ago period. One billion monthly active users is nothing short of incredible. However, it remains to be seen whether or not Facebook can successfully monetize its popular platform.

After the world's most hyped IPO turned out to be a dunce, most investors probably don't even want to think about shares of Facebook. But there are things every investor needs to know about this company. We've outlined them in our newest premium research report. There's a lot more to Facebook than meets the eye, so read up on whether there is anything to "like" about it today, and we'll tell you whether we think Facebook deserves a place in your portfolio. Access your report by clicking here.

The article The Best and Worst Internet Stocks of 2012 originally appeared on Fool.com.

Fool contributor Tamara Rutter owns shares of Amazon.com and Zynga. The Motley Fool owns shares of Amazon.com, Best Buy, Facebook, LinkedIn, and RadioShack and is short RadioShack and has the following options: long JAN 2014 $20.00 calls on Facebook. Motley Fool newsletter services recommend Amazon.com, eBay, Facebook, and LinkedIn. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.