Why MAKO Won't Be in My 2013 Portfolio

At the beginning of 2012, I set out to form The World's Greatest Growth Portfolio. Though I can't promise it will always live up to its moniker, the portfolio has returned 23% in just 11 months, beating the S&P 500 by about 9 percentage points.

A few weeks ago, I outlined exactly how I would go about building my portfolio for next year: Invest first and foremost in companies that demonstrate exceptional levels of innovation, with special emphasis given to those that I believe will be around decades from now.

Today, I'm going to look at MAKO Surgical (NAS: MAKO) , one of my portfolio's worst performers from 2012. Read to see what I plan to do with it next year, and later I'll offer access to a special premium report on the medical company.

A rough year

MAKO's Rio Surgical robots have the potential to help a lot of aging patients stay mobile late into their twilight years. The machines help craft partial knee and hip replacements that better align to the individual contours of a person's joints.

With the aging boomer population entering retirement but showing a desire to stay as active as ever, the company's procedures would be readily adopted. In fact, many believe that MAKO could one day be the next Intuitive Surgical (NAS: ISRG) , whose daVinci Robotic System has been readily adopted by hospitals across the globe over the past decade.

Unfortunately for investors, the tale of this year's tape has not played out to meet the rosy picture mentioned above. The bad news started in early May, when the company announced that it had fallen short of even its low-end sales predictions. The biggest problem came from the fact that it sold only six Rio Systems in early 2012, a yearly drop from 2011.

The bad news continued during the next earnings release in July. Rio System sales again came in low, and when taking the whole year into account, system sales were again down on a yearly basis.

For larger, more mature medical companies such as Johnson & Johnson (NYS: JNJ) , a drop like this might not be too much to worry about. But for a small company that is trying to convince the medical community that its product is worth using, shrinking sales are considered a major red flag. It even led one Fool to compare MAKO to struggling Hansen Medical (NAS: HNSN) , as a "cautionary tale of what can go wrong if adoption fails to materialize in a meaningful way."

Room for a revival

Of course, just because a stock drops doesn't mean that you should forget all about it. In fact, sometimes that can be just the time to buy in.

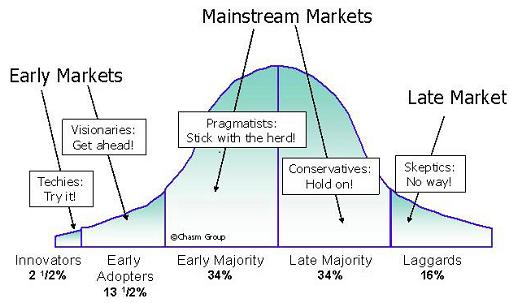

As fellow Fools Dave Meier and John Reeves wrote, they think MAKO is just at a transition point in the adoption curve of Rio Systems. In their opinion, if the company can see its product through this tough time and enter mainstream medical markets, it could gain wide acceptance.

Source: Technology Adoption Life-Cycle by Infrae.

What's a Fool to do?

I'm no medical expert, and I will readily acknowledge that now could be just the right time to be buying into MAKO Surgical. But the bottom line is that we've got a company with management that's having a tough time understanding where it is on the adoption curve. It helps explain why MAKO needed a secondary offering to raise cash late this year.

If I'm going to be investing in high-risk/high-reward companies, I need to know that the management is top-notch; otherwise, I just don't see how it can make its product a breakthrough success.

For those reasons, and because I think there are simply better options out there, I don't think MAKO will have a spot at the table in 2013 for my growth portfolio.

Obviously, the sell-off of MAKO Surgical shares has many wondering whether the potential growth prospects of the robotic surgery company make this stock a buy or a stock to stay away from.

If you'd like a second opinion to answer this question, Fool.com analyst and MAKO expert David Meier has authored a premium research report covering all of the must-know details on the company, including key areas to watch and risks looming in the future. As an added bonus, David will keep you informed with a full year of updates and guidance on MAKO Surgical as news breaks. Click here now to learn more and start reading. .

The article Why MAKO Won't Be in My 2013 Portfolio originally appeared on Fool.com.

Fool contributor Brian Stoffel owns shares of Intuitive Surgical, Johnson & Johnson, and MAKO Surgical. The Motley Fool owns shares of Intuitive Surgical, Johnson & Johnson, and MAKO Surgical. Motley Fool newsletter services recommend Intuitive Surgical, Johnson & Johnson, and MAKO Surgical . Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.