Caribou Coffee to Be Taken Private in $340 Million Deal

Caribou Coffeeannounced today that it has agreed to be taken private by the Joh A. Benckiser Group for around $340 million total, $16 per share. Caribou's independent directors have unanimously approved the deal, which offers shareholders an approximately 30% premium over the coffee company's $12.30 pre-announcement share price.

Caribou will continue to operate independently, managing its own brand, executive team, and growth strategy. The Joh A. Benckiser Group specializes in long-term investments in "premium brands in the Fast Moving Consumer Goods category." It holds majority stakes in Peet's Coffee & Tea and beauty company Coty .

"We anticipate the next chapter in Caribou's journey will be filled with tremendous opportunities to grow this great brand, with new ownership," said Michael Tattersfield, Caribou President and CEO, in a statement today.

"Caribou has a fantastic brand and unique culture, and fits perfectly with JAB's investment philosophy of investing in premium and unique brands in attractive growth categories like coffee," said Bart Becht, Chairman of Joh. A. Benckiser Group. "JAB is committed to investing in Caribou as a stand-alone business out of Minneapolis to ensure the Company continues its current highly successful track record."

Caribou Coffee currently operates 610 coffeehouses in 22 states, the District of Columbia, and 10 international markets. According to the company, based on the number of coffeehouses, Caribou is the second-largest company-operated premium coffeehouse operator in the United States. It was founded in 1992.

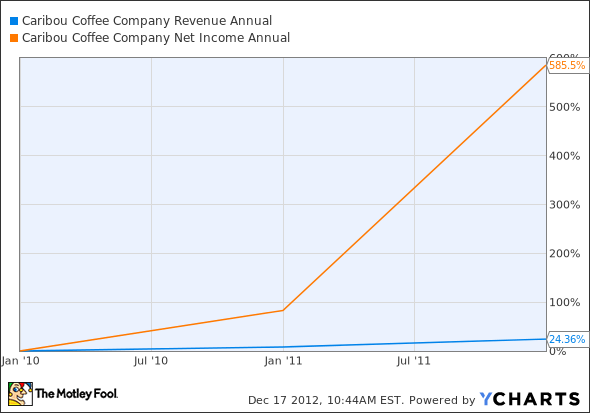

Since 2010, the company has boosted sales by 586% and net income by 24%.

CBOU Revenue Annual data by YCharts

The article Caribou Coffee to Be Taken Private in $340 Million Deal originally appeared on Fool.com.

Justin Loiseau has no positions in the stocks mentioned above, but he does enjoy a good cup of joe. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo. The Motley Fool has no positions in the stocks mentioned above. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.