Breaking Down Exactly Why Investors Should Consider Nuance in 2013

The market hasn't been too kind to mobile growth play Nuance Communications so far this year. Nearing the end of 2012, the company finds its shares down nearly 11%. However, investors have hung with it, in no small part thanks to its close ties to the tech investing storyline of the decade -- the rise of mobile devices such as smartphones and tablets.

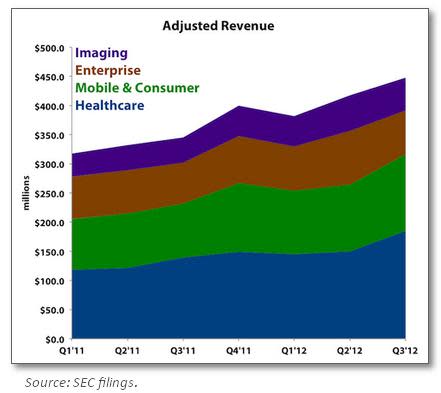

Beyond its slumping share price, though, the company still managed a relatively strong set of financial performances this year, growing its top line by more than 20% each quarter. Translating those results to the bottom line, however, did prove somewhat problematic. Regardless, no one disputes the immense growth potential the company holds, and the potentially massive payouts it could generate for shareholders as a result.

The real question when it comes to sizing up Nuance -- and whether to buy in -- is how likely shareholders are to see this outcome, The Fool recently enlisted one of our star tech writers to create a premium research report on Nuance. To acquaint our readers, we're including a brief excerpt from the report here for you today, free of charge. If you want to learn more about Nuance, you can access the report in its entirety by just clicking here. Enjoy!

The Opportunity

Much of the recent attention that Nuance has received over the past couple years relates to its relationship with Apple as the speech engine driving its Siri virtual assistant. Both Nuance and Siri (before Apple acquired it in 2010) were spun out of SRI International -- Nuance in 1994 and Siri in 2007. As a major technology trendsetter, Apple's focus on voice interactions has catalyzed interest in voice recognition among consumers and rival technology companies alike.

The terms of Nuance's contract with Apple are expectedly shrouded in secrecy, so detailed revenue implications are ambiguous. Thanks in part to Apple's interest, Nuance's mobile and consumer segment has put up strong growth. Through the first three quarters of the fiscal year, mobile and consumer revenue has increased 30% relative the same period a year ago to $356 million. The segment's profit was also up 36% to $149.7 million over that time.

As Siri makes its way into other Apple products, Nuance should continue benefiting, although as previously mentioned, it's unclear to know by precisely how much. Earlier in the year, Nuance simply said its "relationships with mobile customers have become more comprehensive and complex, which has resulted in delayed revenues in some cases, due in part to revenues deferred until completion of certain deliverables and in part to longer negotiation cycles."

Even without transparency into Nuance's relationship with Apple, the numbers continue to speak for themselves: voice will be big part of mobile computing. Nuance even recently introduced its own virtual assistant, Nina, which is similar to Apple's Siri.

Healthcare remains Nuance's largest business, generating 43% of consolidated revenue last quarter. Comprehensive dictation and transcription services should continue to soar in medical settings since it offers convenience, efficiency, and accuracy for care providers and allows them to interact with electronic medical records.

An acquisition in April of this year of Transcend Services for $332.3 million helped bolster Nuance's presence in small- and mid-sized hospitals. Roughly 90% of the hospitals in the U.S. fall into these categories.

As society continues to battle the dangerous urge to text while driving, speech recognition and hands-free interactions in cars will play a large part. Numerous car manufacturers have tapped Nuance to facilitate in-vehicle voice interfaces, including Ford Sync, General Motors' OnStar, and Toyota Motors' Entune. Additional auto customers include Audi, BMW, Fiat, Hyundai, Mercedes, Jaguar, Porsche, Renault, Volkswagen, Nissan, Chrysler, and Mazda. These are included in Nuance's mobile and consumer segment.

Speech recognition is yet another nascent technology set to explode with the rise of tablets and smartphones, and no company is better poised to benefit from this coming boom than Nuance Communications. However, this growth story doesn't come without risks, too. Check out our premium research report to break down what investors interested in Nuance absolutely have to understand before investing, so click here now to grab your copy today.

The article Breaking Down Exactly Why Investors Should Consider Nuance in 2013 originally appeared on Fool.com.

Andrew Tonner owns shares of Ford and Apple. Follow Andrew and all his writing on Twitter: @AndrewTonner. The Motley Fool owns shares of Apple and Ford. Motley Fool newsletter services recommend Apple, Ford, General Motors, and Nuance Communications. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.