3 Companies That Know How to Spend Their Billions

The Standard & Poor's credit ratings agency has an unusual message for cash-rich companies: Start spending that stockpile, or else.

In a new report this week, S&P warns that many companies are keeping too much cash on their books, and forgoing key investments in the future of their businesses. After years of underinvestment in things like innovation and technology, these companies could see their competitive advantage weaken and their profits fall over the long term.

The S&P's warning is aimed at speculative-grade companies, which have underinvested in their businesses by a cool $175 billion since 2009. Instead of hoarding cash, they should look to successful, big-spending tech companies as examples of how to invest for future growth.

Mountains of cash

Most businesses have been shoring up their balance sheets ever since the recession hit in 2008. Capital preservation was all the rage in the aftermath of the financial crisis. And it helped firms navigate the uncertain demand environment that followed the bust.

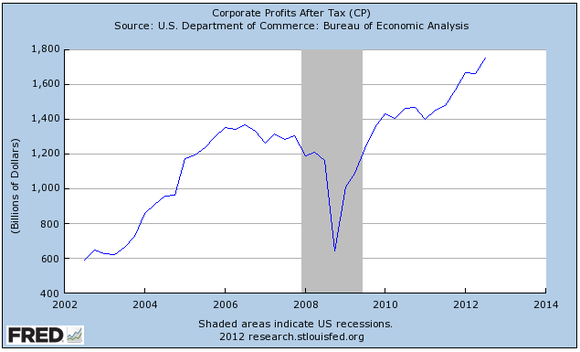

But the strategy has overstayed its welcome. Putting off investments in favor of amassing a big war chest is still in vogue years into the economic recovery. Corporate profits are near all-time highs:

Source: Federal Reserve Economic Data.

Yet cash balances at S&P 500 firms are also surging, and are on track to hit a record $1.5 trillion, according to an analysis by JPMorgan.

Capital investment, the foundation for future profits, just hasn't kept pace. And the problem may be getting worse. According to a report by the Wall Street Journal, 20 of the largest capital-spending companies have announced plans to cut back on spending this year or next. The WSJ cites Caterpillar , which recently said it won't hit its $4 billion spending target this year, as just one example.

A better way

But a few companies have managed to significantly ramp up spending recently while still protecting their cash piles. Google is sitting on more than $16 billion. Intel's coffers were brimming with about $15 billion at the start of the year. And Apple boasts more than $100 billion in cash and equivalents on its books.

But these cash-rich companies didn't get that way by pinching pennies. Just the opposite. Google invested more than 14% of revenue on research and development last quarter. And in the years since the recession, that commitment to R&D has only expanded. In 2009, it was just 12% of revenue. The total R&D figure has leaped from $2.8 billion in 2009 to $5.2 billion last year. You can't hope to create compelling new technology like wearable computers or self-driving cars without shelling out some serious coin.

Ditto for Apple. The iStuff producer spent almost double on R&D this year as it did two years ago. Apple's capital expenditures hit a record $10.3 billion in its 2012 fiscal year, up from just $2.6 billion in 2010. And the company expects to spend about as much next year, with almost $1 billion going toward investments in retail stores and $9 billion funding upgrades to other capital like manufacturing equipment. The company also finally began returning some cash to shareholders in the form of a regular dividend of $2.5 billion each quarter.

And Intel hasn't been afraid to spend money, either. Last year the company invested $11 billion in capital expenditures that went to fund a large-scale upgrade of its fabrication facilities. In just a few years, capital spending has more than doubled for the chip maker, from $4.5 billion in 2009. Intel also routinely sends a ton of cash to shareholders. More than $14 billion went to stock repurchases last year, and over $4 billion to dividend payments.

Send more cash

Still, if there's one of these companies that could stand to follow the S&P's advice more strictly, its Apple. Even with ramped-up spending and a new dividend commitment, the company's cash pile is just too big. Apple's strategy has never rested on huge, expensive acquisitions, so its hard to see any reason for a war chest that massive.

And, if a dividend boost isn't in the cards, then maybe share repurchases are. The company said it could start purchasing up to $10 billion of its own stock beginning next year. With shares well below their September highs, it might be the perfect time to start deploying that cash.

There's no doubt that Apple is at the center of technology's largest revolution ever, and that longtime shareholders have been handsomely rewarded with over 1,000% gains. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on both reasons to buy and reasons to sell Apple, and what opportunities are left for the company (and more importantly, your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

The article 3 Companies That Know How to Spend Their Billions originally appeared on Fool.com.

Fool contributor Demitrios Kalogeropoulos owns shares of Apple. The Motley Fool owns shares of Apple, Google, and Intel. Motley Fool newsletter services recommend Apple, Google, and Intel. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.