Is Clorox Destined for Greatness?

Every investor can appreciate a stock that consistently beats the Street without getting ahead of its fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with improving financial metrics that support strong price growth. Let's take a look at what Clorox's recent results tell us about its potential for future gains.

What the numbers tell you

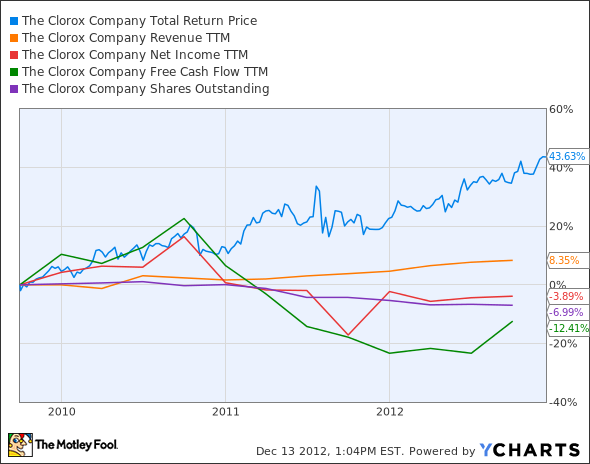

The graphs you're about to see tell Clorox's story, and we'll be grading the quality of that story in several ways.

Growth is important on both top and bottom lines, and an improving profit margin is a great sign that a company's become more efficient over time. Since profits may not always be reported at a steady rate, we'll also look at how much Clorox's free cash flow has grown in comparison to its net income.

A company that generates more earnings per share over time, regardless of the number of shares outstanding, is heading in the right direction. If Clorox's share price has kept pace with its earnings growth, that's another good sign that its stock can move higher.

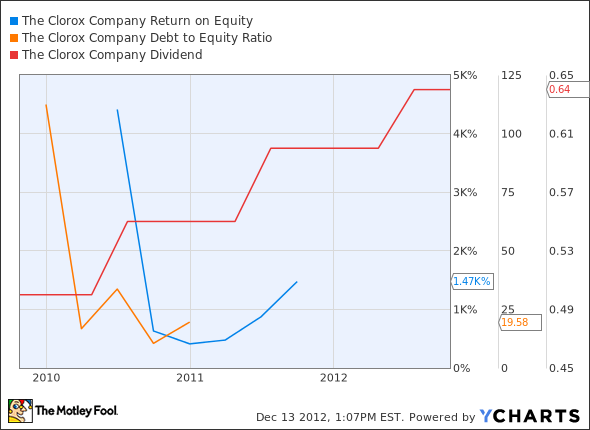

Is Clorox managing its resources well? A company's return on equity should be improving, and its debt-to-equity ratio declining, if it's to earn our approval.

Healthy dividends are always welcome, so we'll also make sure that Clorox's dividend payouts are increasing, but at a level that can be sustained by its free cash flow.

By the numbers

Now, let's take a look at Clorox's key statistics:

CLX Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 8.4% | Fail |

Improving profit margin | (17.5%) | Fail |

Free cash flow growth > Net income growth | (12.4%) vs. (3.9%) | Fail |

Improving EPS | 3% | Pass |

Stock growth (+ 15%) < EPS growth | 43.6% vs. 3% | Fail |

Source: YCharts. * Period begins at end of Q3 2009.

CLX Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | NM | Fail |

Declining debt to equity | NM | Fail |

Dividend growth > 25% | 16.4% | Fail |

Free cash flow payout ratio < 50% | 66.5% | Fail |

Source: YCharts. * Period begins at end of Q3 2009.

NM = not material due to negative equity.

How we got here and where we're going

This was, to put it mildly, not a good showing for Clorox. A lousy one passing grade -- and that only earned by the narrowest of margins -- out of nine, makes Clorox's future look muddled indeed. The company has had negative equity for some time, and its free cash flow and net income are both lower today than they were three years ago. Despite this weakness, Clorox's shares have done quite well, as investors seek out safety and reliable dividends. How reliable are Clorox's dividends, though, at a 67% free cash flow payout ratio? And, more importantly, what can Clorox do to turn these declines around?

Clorox started 2012 at a relatively high valuation, and finishes the year at almost the same level . The company recovered from a failed takeover bid by corporate raider Carl Icahn, but those gains have come almost entirely because of a higher P/E, which has been steadily rising from a low of around 14 in 2009, to 18.2 today. That's in spite of Clorox being one of the weakest consumer-products companies on the market -- its three-year net income decline is worse than all but Procter & Gamble's . Let's take a look at how Clorox stacks up:

Company | Total Stock Growth* | Net Income Growth* | P/E and Five-Year Average P/E |

|---|---|---|---|

Clorox | 43.6% | (3.9%) | 18.2 and 16.2 |

Procter & Gamble | 35.4% | (23.2%) | 18.8 and 15.6 |

Colgate-Palmolive | 52.2% | 14.3% | 20.8 and 18.8 |

Kimberly-Clark | 65.2% | 4% | 17.9 and 15.1 |

Church & Dwight | 99.1% | 41.6% | 22.9 and 16.0 |

Sources: YCharts and Wolfram Alpha.

* Growth over three-year period (since Sept. 30, 2009). Includes dividends.

As you can see, this growth has taken place across the entire sector, regardless of bottom line gains, or P/E starting points. All of these companies offer good yields, as well, but my fellow Fool Sean Williams singled out Clorox as a top choice for dividend seekers earlier this year. His reasoning centers on a recent uptick in sales volume, combined with pricing power that bests most of its peers. I would still be careful of Clorox's runaway stock gains relative to its fundamentals, and would also caution that dividend increases can't continue as they have if Clorox's free cash flow fails to improve.

Clorox's score today is nothing to write home about, and there are plenty of other solid dividend-paying stocks with a history of stronger growth. Clorox might be able to earn more passing grades next year, but it looks a bit shaky right now.

Putting the pieces together

Today, Clorox has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

If you're looking for other dividend payers that haven't run ahead of their fundamentals, the Fool's got a few suggestions -- nine, in fact. Our most popular free report offers nine rock-solid dividend stocks for your consideration, with a solid background on each one to help you decide. Want to learn more? Click here for the information you need, at no cost.

Keep track of Clorox by adding it to your free stock Watchlist.

The article Is Clorox Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+, or follow him on Twitter @TMFBiggles for more news and insights.The Motley Fool owns shares of Clorox. Motley Fool newsletter services have recommended buying shares of Procter & Gamble and Kimberly-Clark Corporation. The Motley Fool has a disclosure policy.We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.