Will This Construction Company Continue to Outperform in 2013?

With 2013 right around the corner, we as investors need to take a look at our portfolios and see what we should do in the upcoming year. To help you along the way, let's take a look at AECOM Technology and see if it can maintain its market-beating performance in 2013.

How it did in comparison to its peers

Company | Net Margins (ttm) | Return on Equity | Forward P/E | Backlog |

|---|---|---|---|---|

AECOM | (0.71%) | (2.47%) | 8.5 | $16B |

Jacobs Engineering | 3.48% | 11.03% | 11.91 | $15.9B |

Fluor | 2.29% | 20.34% | 13.97 | $41B |

KBR | 2.55% | 10.11% | 10.03 | $14.8B |

The Shaw Group | 3.31% | 21.9% | 15.91 | $17B |

Source: Yahoo! finaince and quarterly earnings conference calls

The year that was

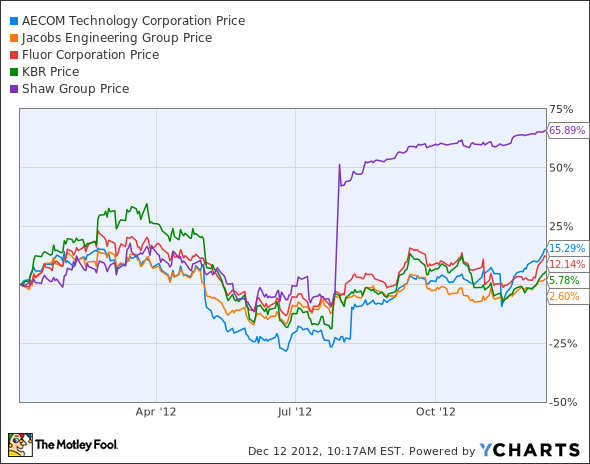

Beside Shaw Group's big jump following the announcement that the company will be bought out by Chicago Bridge & Iron , AECOM's stock has performed the best in comparison to its peers, and has outperformed the S&P 500 by three percentage points.

If the numbers in the table don't quite add up with the stock chart, though, you're right. The reason that AECOM looks so unattractive based on net margins and ROE is because the company enacted a $300 million asset wrtiedown in the past quarter, which made its income statement look miserable. This writedown had almost nothing to do with the company's operational efficiency. If you look at the cash flow statement, you will see that AECOM has generated big chunks of cash in the past two quarters. This big cash haul has really helped the company bring down its debt below the $1 billion mark and strengthen its cash position.

Overall, AECOM had a pretty strong year. While revenue remained relatively flat at $2 billion a quarter for the past four quarters, gross margins improved from 4.4% to 6.9% over that time frame. Also, order backlog has improved by 3% per year since 2011. The company announced back in August that it will be buying back approximately $300 million in company shares, which should help to prop up share prices. With a backlog equal to about two years of revenue, the company is positioned relatively well in the event of a slowdown in construction activity.

What a Fool believes

While there are some promising numbers coming from the company, there are some macroeconomic issues surrounding the construction business that could hurt AECOM in the future. The most obvious one at this time involves the budget cuts associated with the fiscal cliff. AECOM generates 36% of its revenue from federal, state, and local government contracts, and another 25% from foreign governments. Granted, the company is relatively well-diversified geographically, but China's drawback on infrastructure spending, Europe's continued financial woes, and the likelihood of budgetary cuts in the U.S. all add up to a potential rough patch.

It may take a several quarters before any big changes happen with revenue, so to get a better gauge on AECOM's prospects, watch that order backlog. If the backlog starts to shrink, then it may be an indication of tougher times ahead.

If you are considering investing in the construction services industry, it is more than likely you are looking for some portfolio stability. If that is the case, then you should check out how to "Secure your Future with 9 Rock-Solid Dividend Stocks." To get a copy of this free report, click here.

The article Will This Construction Company Continue to Outperform in 2013? originally appeared on Fool.com.

Fool contributor Tyler Crowehas no positions in the stocks mentioned above. You can follow him on Fool.com under TMFDirtyBird, Google +, or Twitter @TylerCroweFool. The Motley Fool owns shares of Fluor. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2012 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.